Tombs are an important part of social funeral etiquette at that time, an important carrier to show the social material level, and an important window to map the social economy, culture, art and spiritual beliefs at that time. In the Song Dynasty, in Sichuan, Chongqing and Guizhou, a kind of stone tomb with portraits was popular, mainly distributed in mountains and hills. Taking this kind of tombs as an example, this paper discusses the multiplicity of their space.

Song tomb space includes three aspects. First, the terrain environment where the tombs are located can be called environmental space; Second, the physical space of tombs, including tombs, surface cemeteries and other remains; Third, the post-death world conveyed by the tomb entity can be called illusory space.

1 environmental space

As the name implies, environmental space refers to the terrain environment where tombs are located, that is, the burial site environment. In the Song Dynasty, influenced by the geomantic geomantic omen doctrine, the site selection of tombs often required geomantic exploration.

The Song Dynasty is the heyday of the development of Feng Shui theory, and the Neo-Confucianism in the Song Dynasty also participated in the study of Feng Shui theory. Cheng Yi in the Northern Song Dynasty said in "The Theory of Burial": "He who has the beauty of the earth has peace of mind and his son Sun Sheng. It is natural to cultivate its roots and flourish. The evil of the earth is the opposite. But who is the beauty of the earth? The smoothness of the earth color and the lush vegetation are its tests. Fathers, ancestors and descendants share the same spirit. If there is peace, there is security, and if there is danger, there is danger. It is also reasonable. " In the Southern Song Dynasty, Zhu Xi also studied the problem of geomantic omen. "Zhu Ziyun must bow in the face of the situation, and there is no space to surround it, which is also the extreme intention of a benevolent son." The theory of geomantic omen embodies the realistic demand of its purpose: the prosperity of future generations. Because the fathers, ancestors and descendants share the same spirit, security and danger are integrated into one, and the prosperity of future generations first needs the peace of the fathers and ancestors, and one side is the premise. The terrain is superior, "the situation is arched and surrounded by no empty place." On the other hand, seeking a good land through geomantic omen, which makes the father and the ancestors peaceful, is also "the extreme of benevolence and filial piety" and the expression of Confucian filial piety.

The Song Dynasty was also the final period of the formation of Xingfa Sect in Jiangxi and Liqi Sect in Fujian, with Xingfa Sect as the mainstream. Zhao Yi, a Qing Dynasty man, pointed out in Yu Cong Kao: "The method of saying" house and house "began in the middle of Fujian, and became popular in the Song Dynasty. She was born in the star divination, with the sun rising in the mountains and the sun rising in the mountains, and the yin rising in the mountains, and took the five-star gossip purely to determine the principle of life and grams. One said that the method of Jiangxi originated from Yang Junsong, Zeng Wendi, Lai Dayou and Xie Ziyi in the middle of Jiangxi. It was said that the main thing was the situation, that is, the original action, that is, the stop, and the orientation, specifically referring to the matching of sand and water in the dragon cave. The theories of the two schools are popular, while the theory of Gan is better. "

In mountainous and hilly areas, the burial environment of Song tombs is generally backed by water in front and surrounded on the left and right, which corresponds to the "dragon, cave, sand and water" emphasized by Xingfa Sect. The Anbing Tomb in Huaying, Sichuan Province, sits east to west, and is located in the foothills of Huanran Mountain in the middle of Huaying Mountain Range, with Pine Mountain in the south, Wang Jialiang Son in the north, and two hills in the west, with a gentle valley in between; The gully water flows into the Longdong river ditch on the north side, and then meanders to the west. The Song Tomb of Foyan Temple in Yongchuan sits west to east, and is located at the front end of the triangular mountain mouth with shallow hills. The layers of paddy fields on the north and south sides meet in the east, and there are hills outside, adjacent to Dazhuxi in the east and Huanggua Mountain in the west.

Local geographical environment of Foyan Temple tombs in Yongchuan

Local geographical environment of Foyan Temple tombs in Yongchuan

It can be seen that in mountainous and hilly areas, the burial environment of the Song tombs is arranged in a mountain-like water potential, and there is no unified insistence on the direction of the tombs, which is different from the fact that the Central Plains follows the "five-tone surname benefit method", which is the result of different geomantic theories.

2 physical space

Physical space includes tombs, cemeteries and other ancillary facilities on the ground. There are few high-grade tombs in the portrait stone tombs of Sichuan, Chongqing and Guizhou, and because of the disturbance of later generations, few remains of the Song tomb cemetery have been found. The tomb of Anbing mentioned above is one of the highest-ranking tombs of Pinguan in Sichuan Basin. An Bing died in the 14th year of Lizong Jiading in the Southern Song Dynasty (1221). He was given Shao Shi as an official, and was given a posthumous award. The cemetery and its ancillary facilities can be seen in tombs, enjoying halls, worshipping Taiwan, Jiucengkan, Shinto, Jiulong Bridge, Zhaoxun Temple and other sites. Most of the other tombs only have the structure of the tomb in the tomb, as well as the remains of the drainage ditch and the tomb road connected with the tomb.

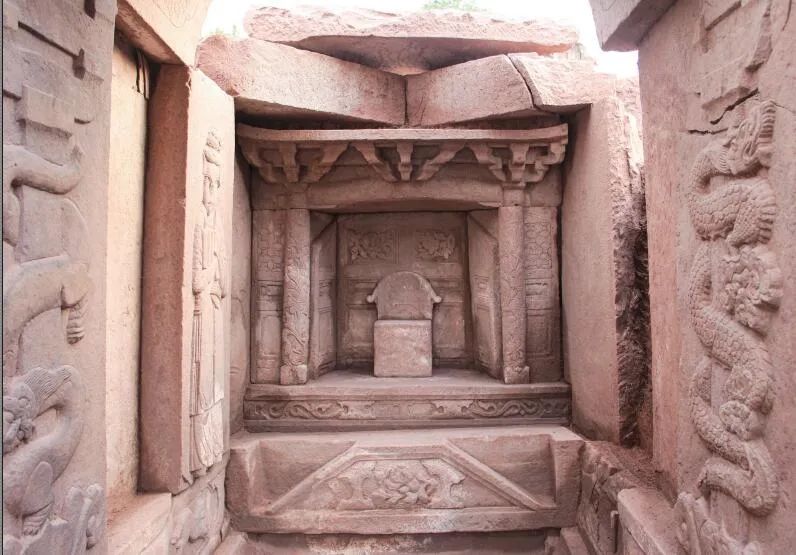

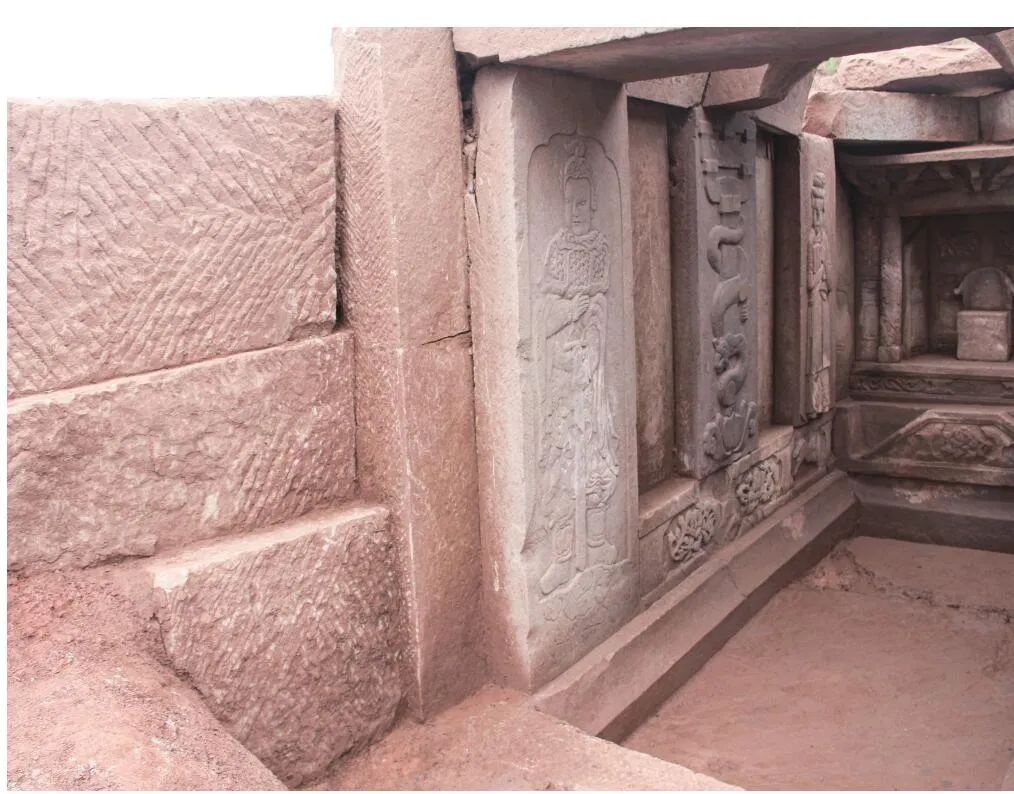

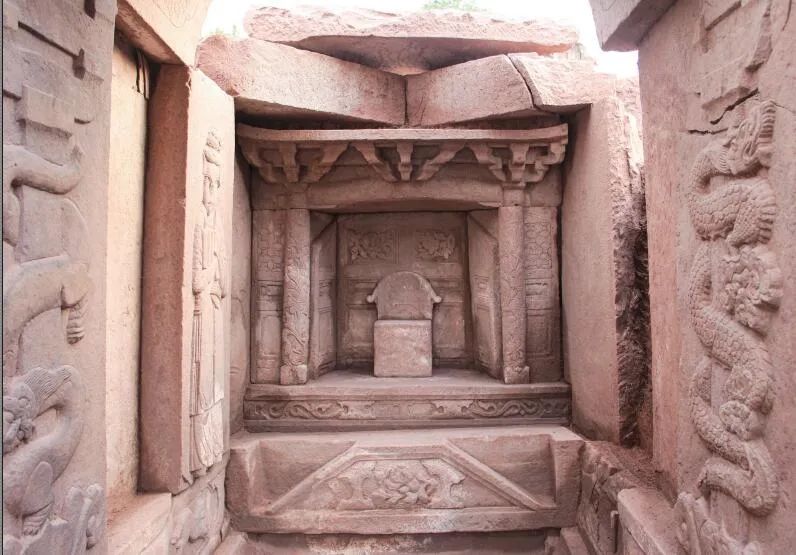

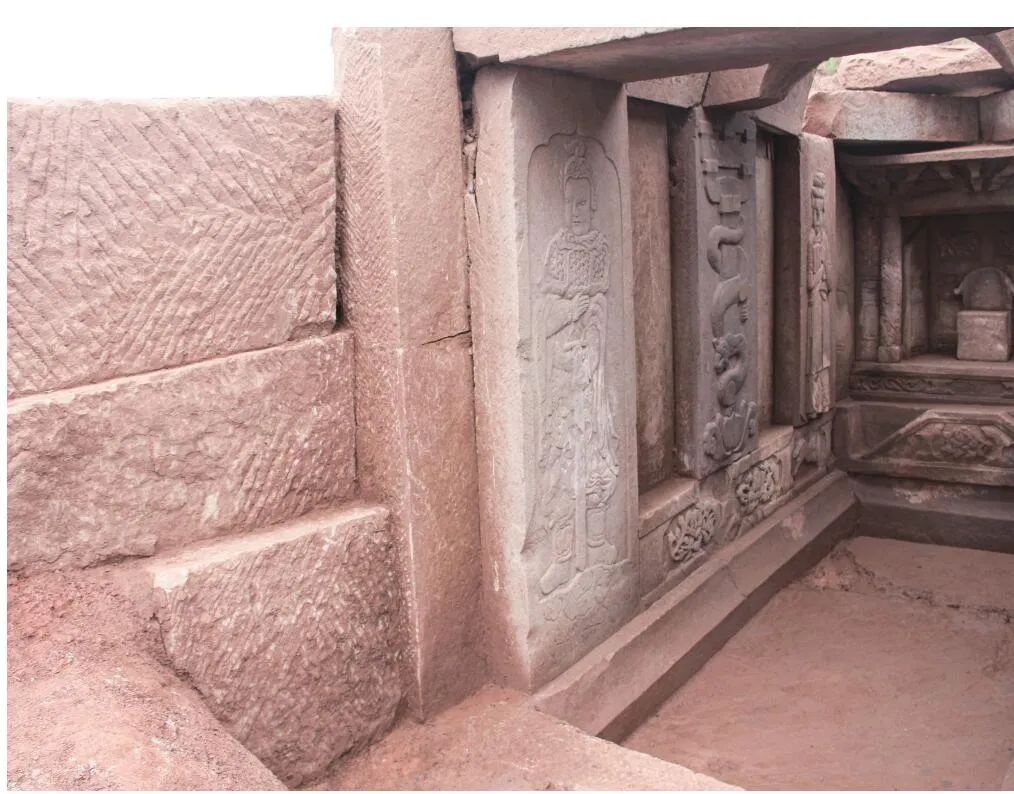

The interior decoration of stone tombs in Sichuan, Chongqing and Guizhou is imitation wood structure and various portrait themes, which some scholars call imitation wood structure stone tombs. There are carved stone components outside individual tombs, such as the Song Tomb at Shapingba Wellhead, the head of the town tomb between the lintels of the Song Tombs of Jiangjiazui Tombs, and the stone lions outside the Song Tombs of Jiangjin Shifosi Site.

According to relevant research, the distribution range of wood-like stone tombs is Dazhou in the east, Leshan in the west, Zunyi in the south and Guangyuan in the north, with Dazu to Chongqing as the center. Wood-like structures such as beams, columns, beams, foreheads, arches, doors and windows are carved in the tomb by means of round carving and relief, which are displayed on the back wall, side walls and top of the stone tomb, and together with decorative warriors, literati, waiters, stories of characters, four gods, flowers, animals and birds, furnishings, inscriptions, mountains and rivers, etc., form an underground tomb space. Decorative themes include four gods, eight diagrams, cranes and other patterns with Taoist factors, lotus flowers, lions, elephants, metaplastic boys, Buddhist scriptures and so on with Buddhist elements, as well as sitting statues, trips, furnishings, male and female attendants of the tomb owners and couples reflecting secular life, which is the embodiment of the integration of Confucianism, Buddhism and Taoism in the tombs in the Song Dynasty.

Sculpture of Song Tomb in Jiangjin Baisha Middle School

Sculpture of Song Tomb in Jiangjin Baisha Middle School

In addition to decoration, the tomb space also includes funerary objects and coffins. Because there are almost no coffins in the stone carvings of the Song tombs, I will not explain them. In terms of funerary objects, compared with the brick tombs of the Song Dynasty in Chengdu Plain, there are more figurines in the tombs, such as warriors and waiters. In the portrait stone-carved tomb, the warrior figures appear as stone-carved warriors on the doorpost stone under the lintel stone, and the waiter is located on the back wall or niche of the tomb wall. The funerary objects include bowls, plates, saucers, pots, cans, etc., which are manifested as offering containers, together with the tomb owner’s position symbolized by the niche behind the tomb, reflecting the sacrificial behavior existing in the tomb. Therefore, the stone carvings, funerary objects and tomb space in the tomb are interrelated and integrated with each other, and jointly create the underground space of the tomb owner’s dead soul.

3 Unreal space

Unreal space is the afterlife world conveyed by the tomb entities. With the integration of Confucianism, Buddhism and Taoism in the Song Dynasty, people in the Song Dynasty had many understandings of the world after death, such as logging into fairyland, dying in pure land, or enjoying a rich and auspicious life as secular. The inscriptions of "Jue", "Zao", "Lu", "Wishing", "The Second Road to the West" and "Being Accepted by Life" were found in Nanchuan’s tomb of the Southern Song Dynasty. The stone carvings included lions, elephants and baby plays, and the inscription "There is no mercy and compassion in the Southern Song Dynasty’s tomb of Zhang Zishuo" showed the tomb owner’s desire to live in a western Buddhist country. In the Southern Song Dynasty, the back wall of Yu Gong’s couple’s tomb is carved with a fairyland "Penglai Map". The lower part of the map is carved with tides, and the upper part is Penglai Fairy Mountain. The stone steps detour up to the top of the mountain. There is a crane perched at the foot of the mountain, and a bearded elder at the foot of the mountain faces the hiking trail, which is the most intuitive expression of the tomb owner’s desire to log in to fairyland after death. The Song Tomb in Mo ‘erpo, Longshui, Dazu shows the stone carvings of playing and listening to songs, and the stone carvings of instrumental performance, dance and opera performance are seen in the Song Tomb in Luxian County, which are the reappearance of secular life.

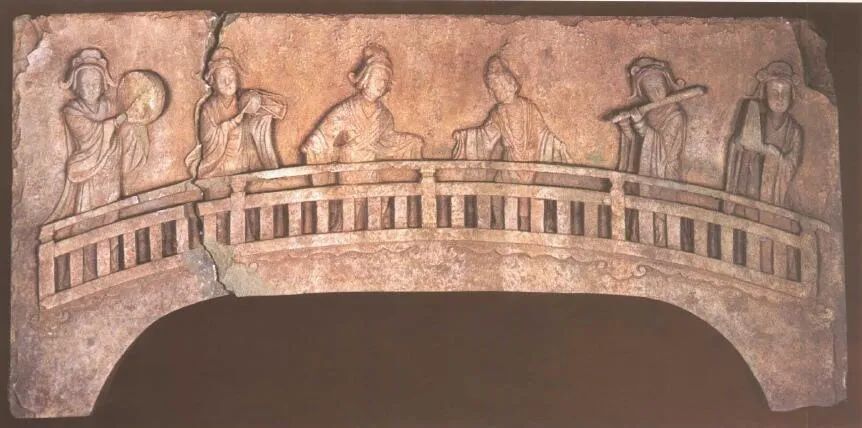

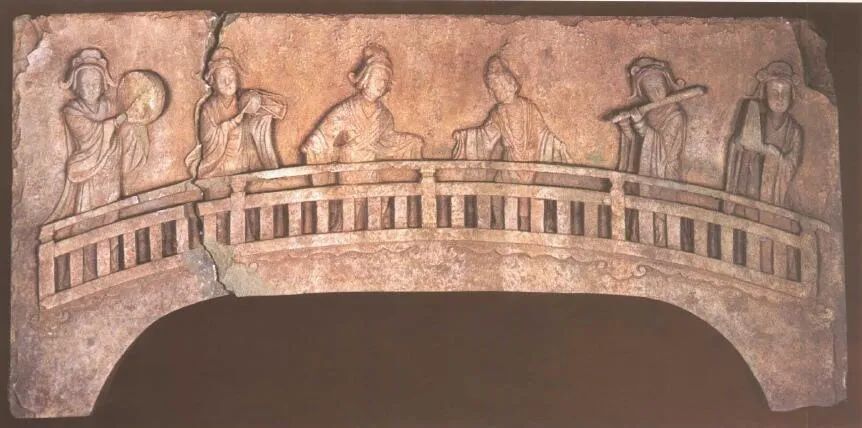

Music and Dance Stone Carvings in Song Tombs in Luxian County

Music and Dance Stone Carvings in Song Tombs in Luxian County

Dance Stone Carvings in Song Tombs of Luxian County

Dance Stone Carvings in Song Tombs of Luxian County

Nanchuan came to visit the coffin of the Song tomb.

Nanchuan came to visit the coffin of the Song tomb.

"Penglai map" on the back wall of the couple’s tomb written by Yu Gong in the Southern Song Dynasty

"Penglai map" on the back wall of the couple’s tomb written by Yu Gong in the Southern Song Dynasty

The illusory space is detached from the claustrophobia of the actual underground tomb space, suggesting the continuation of the space behind the tomb wall through the lattice doors, screens and curtains that imitate the wooden structure. Images of the Four Gods are also common in the tombs of the Song Dynasty, generally about Qinglong and Baihu, and about Suzaku Xuanwu. In the land purchase vouchers of the Song Dynasty, it is common to say that "Qinglong in the east, Baihu in the west, Xuanwu in the north and Suzaku in the south" is actually to express the seclusion of underground space, break the claustrophobia of actual space and show the freedom of the tomb owner’s dead soul.

The physical space of the tomb is not disturbed, and the underground space is stable, which is the basis to ensure the existence of the illusory space. Cheng Yi’s "Burial Theory" says that the choice of burial site requires that "the future must not be a road, a castle, a ditch, a potential, or a plow", which means that the tomb entity will not be disturbed by the activities of the world; The underground space is stable, so it is necessary to "dig the ground to 40-50 feet, and wear it even more when encountering stones, which is waterproof and moist." In the actual excavation of Song tombs, the common tombs and stone blocks are also measures to ensure the stability of the tombs.

The stability of the illusory space lies in not being disturbed by evil spirits and ghosts, and it is embodied in the portrait stone tomb by town tomb warriors, supernatural images, land purchase vouchers, town tomb texts, gossip patterns and so on. For example, the side walls of the Song tombs of Hejiawan Tombs in Hechuan are carved with patterns such as gate post warriors, green dragons and white tigers. The back wall of Yang Yuanjia’s husband and wife’s joint burial tomb in Beibei is engraved with the inscription of the town’s tomb, which contains the sentence of "forbidding all taboos and not doing anything to harm the gas". On the side wall of the Song tomb in Guantian, Zheng ‘an, Guizhou, there are sculptures of animal heads and personal warriors, which are mouse heads and snake heads respectively. The briefing thinks that it is related to the town tomb. The bagua pattern on the top of the tomb also has this function, such as the bagua phoenix picture on the Song Tomb of Sanxizi in Jiangjin, and the bagua picture on the top of the Song Tomb of Jiangjiazui Tomb Group in Shapingba.

Decoration at the Back of Hejiawan Tombs in Hechuan

Decoration at the Back of Hejiawan Tombs in Hechuan

Side wall decoration of song tombs in Hejiawan tombs in Hechuan

Side wall decoration of song tombs in Hejiawan tombs in Hechuan

Burial objects in the back niche of the Song Tomb of Jiangjiazui Tomb Group in Shapingba

Burial objects in the back niche of the Song Tomb of Jiangjiazui Tomb Group in Shapingba

The beast head and personal warrior in the Song tomb of Guantian in Zheng ‘an, Guizhou

The beast head and personal warrior in the Song tomb of Guantian in Zheng ‘an, Guizhou

Map of Eight Diagrams and Phoenix Birds in Song Tomb of Sanxizi in Jiangjin

Map of Eight Diagrams and Phoenix Birds in Song Tomb of Sanxizi in Jiangjin

4 Trinity

The three aspects of the space of the tomb in the Song Dynasty all serve the tomb owner and the bereaved family, which are trinity and unified in purpose. "Buried Sutra" says: "Buried people hide and take advantage of anger." The theory of geomantic omen from the Eastern Jin Dynasty to the Ming and Qing Dynasties runs through the thought of "the theory that the remains are shaded", which is basically the realistic demand that the gods are safe and the descendants are prosperous. In taking care of the actual needs, express Confucian filial piety. According to the previous review, the construction of physical space, illusory space and geomantic choice of environmental space of tombs all have the common purpose of making the father and the ancestor "safe".

The physical space is not disturbed and the tomb is stable. On the one hand, illusory space protects peace, on the other hand, it constructs a Buddhist country, a fairyland and a prosperous and auspicious secular life, satisfying the world’s pursuit of the other side of the world after death, which is the embodiment of its spiritual belief. The purpose is to appease the dead and seek the peace and harmony of the fathers and ancestors, which is "for the sake of the dead." The realistic demand for the prosperity of children and grandchildren is the embodiment of "the plan for the living".

The "plan for the living" of the Song tomb is also reflected in the construction of the living tomb. The tomb is the Shoutang, which was built for the tomb owner before his death, in order to pray that the tomb owner will live a long life. Inscription of the Song Tomb in Shabazi, Rongchang, Chongqing: "Yingjing Zhengjiro is a famous horse, and the word is Dejun, and this Shoutang was built." Notes on the Land Purchase Voucher of Song Tomb in Rongchangba, Guizhou Province: "The establishment of Shoutang No.2 Institute … is based on the fact that a stone man can speak, a stone horse can do it, and the stone deed is □, and the phase begins to call each other, and according to this oath, the life will last for thousands of years. After the construction, Shoutong Peng Zu is willing to be as rich as a hundred years, a thousand children and grandchildren, and as rich as a golden wall in Shi Chong. " The Shoutang bears the good wishes of the tomb owner himself and for future generations, and the "plan for the living" is vividly reflected.

In a word, taking the stone tombs with portraits of Sichuan, Chongqing and Guizhou in the Song Dynasty as an example, the Song tombs have triple spaces, such as environmental space, physical space and illusory space, which jointly serve the tomb owners and the bereaved, bear many prayers of the living and the dead, are the link between life and death, and are also the places where reality and emptiness are transformed.

(The author of this article is an associate researcher at the Institute of Archaeology, Chongqing Institute of Cultural Relics and Archaeology. The original title is "On the Triple Space of Song Tombs —— Taking the Stone Tombs with Portraits of Sichuan, Chongqing and Guizhou as an Example". The full text was originally published on the official WeChat of Chongqing Archaeology. )