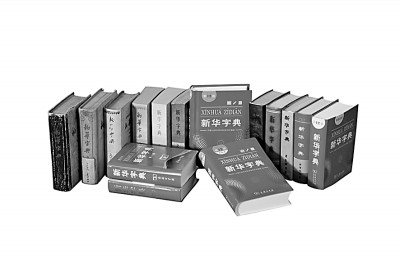

The pictures of Xinhua Dictionary are provided by the Commercial Press.

The joyful scene when the students received Xinhua Dictionary. Image courtesy of the Commercial Press.

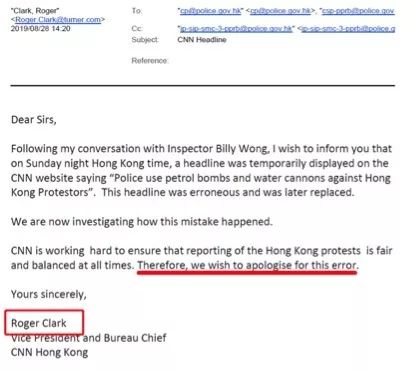

Figure 1

Figure ii

Figure 3

Figure 4

Figure 5

Figure 6

Figure 7

[The editor said]

editorial comment/note

Xinhua Dictionary is the most influential modern Chinese dictionary in New China. Xinhua Dictionary has been compiled and published since 1950. It has been 70 years since it was published in the 12th edition.

As a small Chinese reference book, it provides the most useful information of word form, sound and meaning in a small space, which is deeply loved by readers and has become a mentor and friend for hundreds of millions of people to read and learn culture. During the National Day, Bright Reading was specially planned — — The special edition on the revision of Xinhua Dictionary and the cultural development of new China shows the new achievements of socialist construction and the country’s civilization and progress with a small dictionary through the personal stories of the revisers and users of Xinhua Dictionary.

Xinhua Dictionary is not only the most familiar and beloved language reference book for generations of people in New China, but also one of the most iconic cultural and educational products at the beginning of the founding of New China. The compilation of Xinhua Dictionary marks the arrival of a brand-new era of unprecedented educational development and cultural popularization in China’s 5,000-year history. The publication of the 12th edition is a full demonstration of the original intention of Xinhua Dictionary to inherit the tradition, keep pace with the times and serve the Chinese people in the new era.

New China’s iconic cultural products

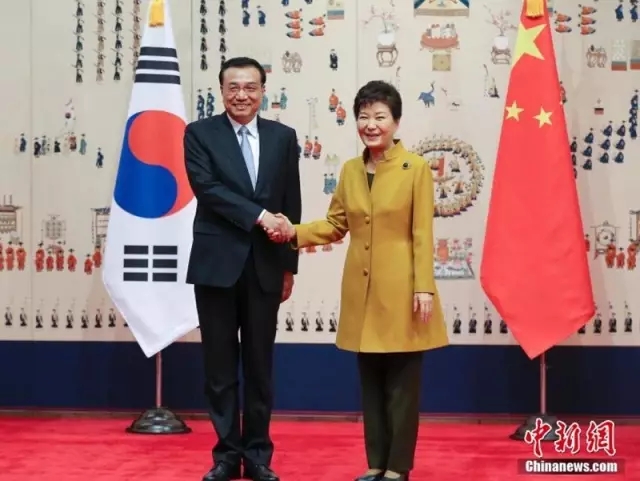

The word "Xinhua" in "Xinhua Dictionary" truly reflects its similarity with the new China — — The close ties between New China. At the beginning of the founding of New China, everything needs to be done. The national economy should be restored, national education should be popularized, and the culture of cadres and masses should be improved. A useful, applicable and authoritative dictionary that can meet the basic needs of Chinese people in learning culture and reading and writing has become an urgent and long-term need of the country and society. A famous writer and educator, Mr. Ye Shengtao, then deputy director of the General Administration of Publication of the Central People’s Government and director of the Editorial Bureau, was anxious about the urgency of the country and thought of the people, and promptly initiated the establishment of Xinhua Dictionary Society in August 1950. It has been 70 years since then, thus starting the compilation of Xinhua Dictionary, and entrusted the famous linguist Mr. Wei Jiangong to preside over the compilation, and Mr. Ye personally took the position of dictionary examination and approval. Through the efforts of Qi Xin, the chief editor and editors, Xinhua Dictionary was officially published in December 1953. As soon as Xinhua Dictionary was published, it won the love of teachers, students and hundreds of millions of people because of its high quality, convenience and ease of use. It became a mentor, friend and even lifelong companion for the masses to read, read and learn culture, and soon became the most authoritative small-scale Chinese dictionary in the eyes of all walks of life. It was also repeatedly given to foreign leaders, overseas cultural and educational institutions or rural students’ families when visiting in China as a precious gift by national leaders. 2019 "Large-scale Achievement Exhibition to Celebrate the 70th Anniversary of the Founding of People’s Republic of China (PRC)"Xinhua Dictionary counter was set up, which was filled with various editions of Xinhua Dictionary published over the years, and established its status as a symbolic cultural product of New China.

In 1956, the state merged the Xinhua Dictionary Society into the Institute of Linguistics of China Academy of Sciences (now the Academy of Social Sciences). As a result, the compilation and revision of Xinhua Dictionary fell on the shoulders of the Institute of Linguistics, and the publishing task of the dictionary was also transferred to the Commercial Press, thus starting the cooperative relationship between the Institute of Linguistics and the Commercial Press in the compilation and publication of dictionaries for more than 60 years. Both sides worked together to maintain and continuously improve the academic quality and social influence of Xinhua Dictionary.

Lean, lean, keep pace with the times.

The life of dictionaries is being revised with the times. The periodical revision of dictionaries, on the one hand, is in response to the development and changes of the language itself brought about by the development and progress of the times, and on the other hand, it relies on the new achievements of academic research to continuously improve the quality of compilation, which is scientific, normative and practical, so that small dictionaries can keep improving, keep up with the times and never end, so that teachers, students and people from all walks of life can have an updated dictionary and a better dictionary in their hands and desks. Xinhua Dictionary has been revised and ushered in today’s 12th edition.

The revision of Xinhua Dictionary has always been a major event for the Institute of Linguistics. Every time it is revised, the institute mobilizes elite soldiers to ensure the quality of the revision. Many academic masters in history personally presided over the revision, forming the tradition that the master revised the small dictionary.

When each edition is released, it is also the beginning of the revision of the next edition. After the release of the 11th edition in 2011, two or three years later, we began to prepare for the revision of the 12th edition, and made preparations in all aspects, and officially started the revision in 2015. This revision is the first revision after entering a new era, and we attach great importance to it. In 2017, the original dictionary editing room was expanded into the Dictionary Compilation Research Center of China Academy of Social Sciences with the strong support of the hospital leaders. The Xinhua Dictionary editing room was specially set up below to strengthen the editing work of Xinhua Dictionary. Through extensive discussion, multiple surveys, special research, key research, individual division of labor, teamwork, listening to opinions, and repeated polishing, the revision team overcame difficulties at the special moment of the epidemic and completed the final sprint of editing and proofreading with colleagues from the Commercial Press. Finally, the twelfth edition of Xinhua Dictionary was launched on the occasion of the 70th anniversary of its compilation.

A newer dictionary, a better dictionary.

This revision puts forward higher requirements in terms of ideology. Comprehensive inspection, strict review of manuscripts, and further enhance the positive energy of dictionaries. In addition, this revision mainly improves the contents and styles of dictionaries in the following aspects.

(A) to further implement the national norms to meet the needs of teaching.

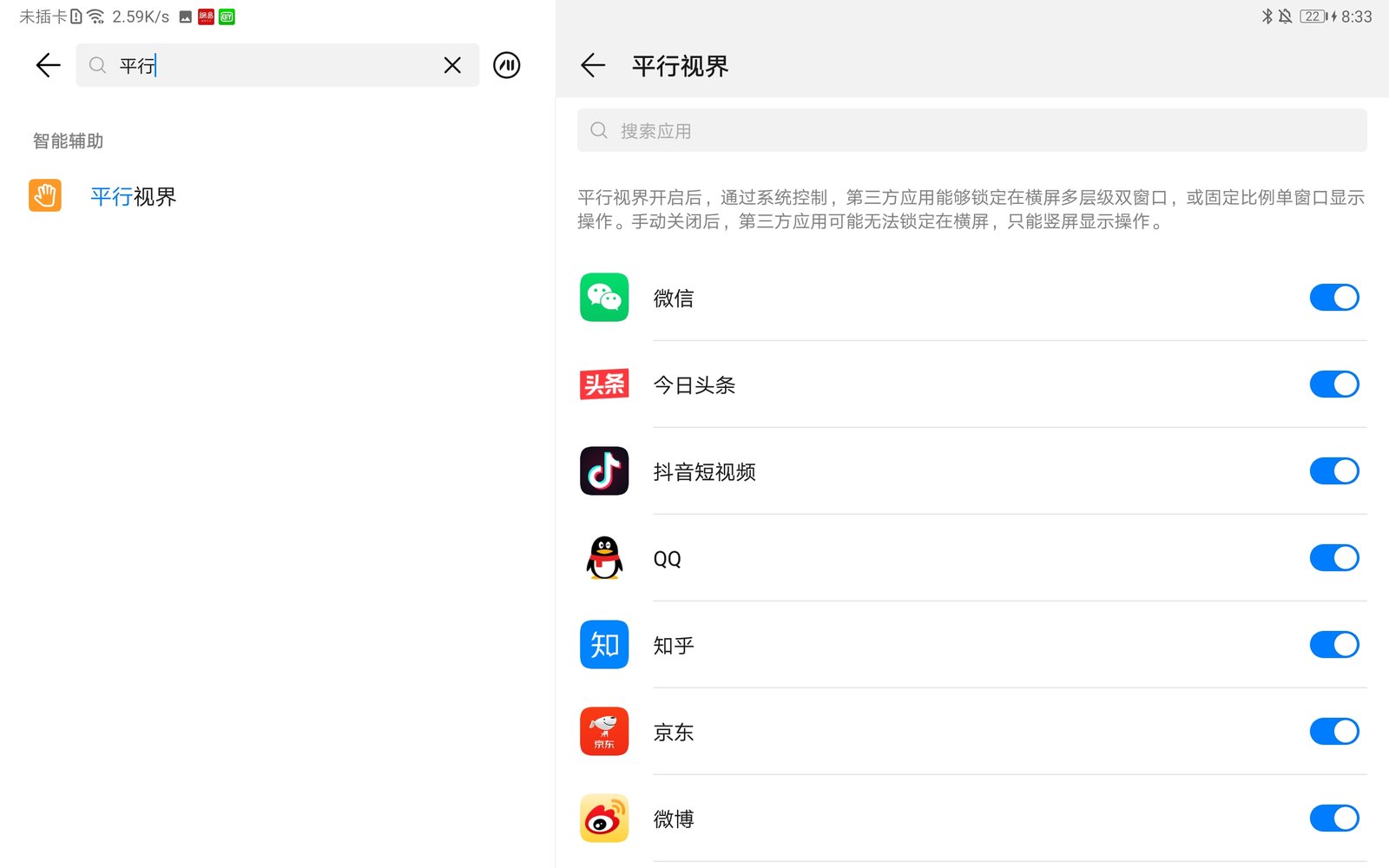

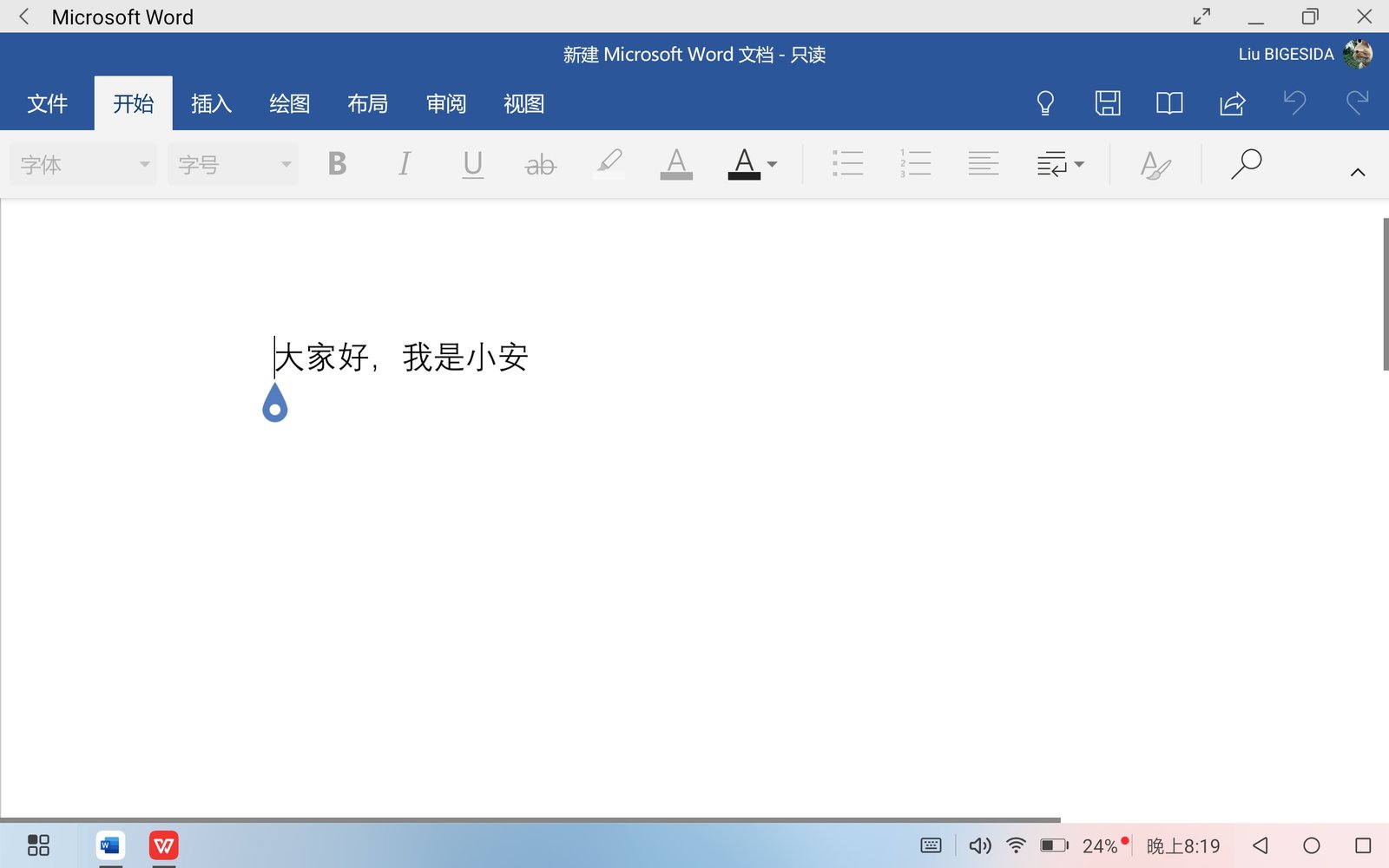

One of the key points in this revision is to further implement the national character specification. In addition to a comprehensive collection of 8,105 standardized Chinese characters in the List of General Standardized Chinese Characters published in 2013, several new standardized characters approved after 2013 — — Some new elements, such as "[see Figure 1] (ǐ) n ǐ" [see Figure 2] (ǐ) f ǐ "[see Figure 3] (ǐ) Li" [see Figure 4] Tiá nǐ”“[ see Figure 5] ao ",etc. At the same time, according to the needs of teaching, the Chinese characters that are not included in the List of Chinese Characters of General Specification, which is involved in the latest primary school Chinese textbook compiled by the Ministry of Education, are supplemented, such as "[see Figure 6 ]qū", "Yu Yu è" and "[see Figure 7] (ruí)". Thus, the full coverage of the Chinese characters in the General Standard Chinese Character List and the primary school Chinese textbook compiled by the Ministry of Education is realized.

From the 1953 edition of Xinhua Dictionary, 6840 words (including variant characters) were collected, and by the 12th edition, 13000 words were collected, which nearly doubled, including 9460 standardized prefixes.

(two) to guide the pronunciation and the use of Chinese characters.

Guide pronunciation norms by adding prefixes to contemporary pronunciation. For example, the word "kui" of "scarcity" supplements the first reading of "kui" in Zhang Zhongjing’s classic of traditional Chinese medicine "synopsis of the golden chamber" in the Eastern Han Dynasty, and in addition, it adds the prefix pronunciation of "horseshoe crab" to the common place name "horseshoe crab fish pond" in Hong Kong SAR. We made a special study on this word, and finally determined that the Cantonese word "horseshoe crab zé" is a more appropriate pronunciation.

Guide the use of Chinese characters by improving the interpretation language. For example, Shenyang’s "Shen" is regarded as a sunken "chén" in ancient books. It was previously said that "Shen" also has a pronunciation of "chén", "Shen chén is the same as ‘ Shen ’ Give people a misunderstanding that "Shen" can still be used as a sunken "Shen", and we write "Old Tong ‘ Shen ’ " Just added a word. After the whole batch of processing, it is more clear and standardized, that is, the word can be used as sunken "Shen" in the past. Today, we should not write "Shen" in Shenyang, which not only takes care of the demand for reference, but also highlights the standardization.

(C) add new words and new meanings to reflect contemporary language life

Within the capacity of small dictionaries, keep up with the times, analyze the realistic corpus, and add some new words and meanings that have been stabilized in recent years. According to the order of sound, for example, add "off the charts, Booming Red, Blogging Eye, Crowdfunding, Initial Heart, Punching in, Purchasing, Driving on behalf of the Driver, Endorsement, Receiving Payment, Like, Top Design, QR Code, Anti-corruption, Fans, Intangible Cultural Heritage, Craftsman Spirit, official website, Returnees, scalpers, Screenshots, Drunk Driving, Garbage Sorting, Support, Traffic, Naked. Some disyllabic words are quoted in square brackets under the words and given a brief explanation. For example, under "Chu", the following words are added: [Chu Xin] Initial wishes and beliefs: ~ Do not change | Do not forget ~; Some of them appear in the form of single-word examples, such as adding intangible cultural heritage under the prefix of "Fei" and adding online shopping under the meaning of "Buy". It has increased the atmosphere of our life now.

Add some words and expressions that are close to contemporary social life, such as the related new meanings added under the words "Ba, Bei, Chao, Chao, Dang, Gua, La, Meng, Pai, Spell, astringent and poisonous". For example, the meaning of "Meng" is added: immature and lovable: selling ~ (pretending to be cute to be lovable); This is a common word in modern times. [Charging] Adding figurative meaning: supplementing knowledge, improving skills, etc.: Only by constantly ~ can we keep up with the times.

According to the language facts and actual use, some definitions are improved and perfected, such as: [media] refers to the tools for disseminating information, such as newspapers, radio, television, Internet, etc.: network ~. It turns out that there is no Internet or online media in the 11th edition.

Combining academic research with field investigation, the entries involving geographical names were comprehensively revised. Some words have added the meaning of place names, such as "Zui": the popular word "Zui" (now mostly used for place names): Tsim Sha ~ (in the Hong Kong Special Administrative Region). "Dang": the same as "Dang" (mostly used for place names), because this word is used in Macao: ~ Tsai (z? i) Island (in the Macao Special Administrative Region). Some have revised their definitions according to the changes of administrative divisions, such as "Heè ng": used for place names: Da ~ Shang (in Jizhou, Tianjin) (11th edition is "Jixian"), and now the 12th edition is written in Jizhou, Tianjin.

Other improvements include: illustrations pay attention to comprehensiveness and systematicness; Improve and perfect the "radical dictionary" to make it more convenient for readers to search words; Based on the actual needs of the contemporary era, the Comparison Table of New and Old Glyphs has been re-compiled, and according to the Usage of Punctuations (GB/T 15834— In 2011, the Summary of Usage of Common Punctuations was updated, and the List of Area, Population and Capital of Countries and Regions in the World, the Summary of Geological Years and the Periodic Table of Elements were updated according to new information.

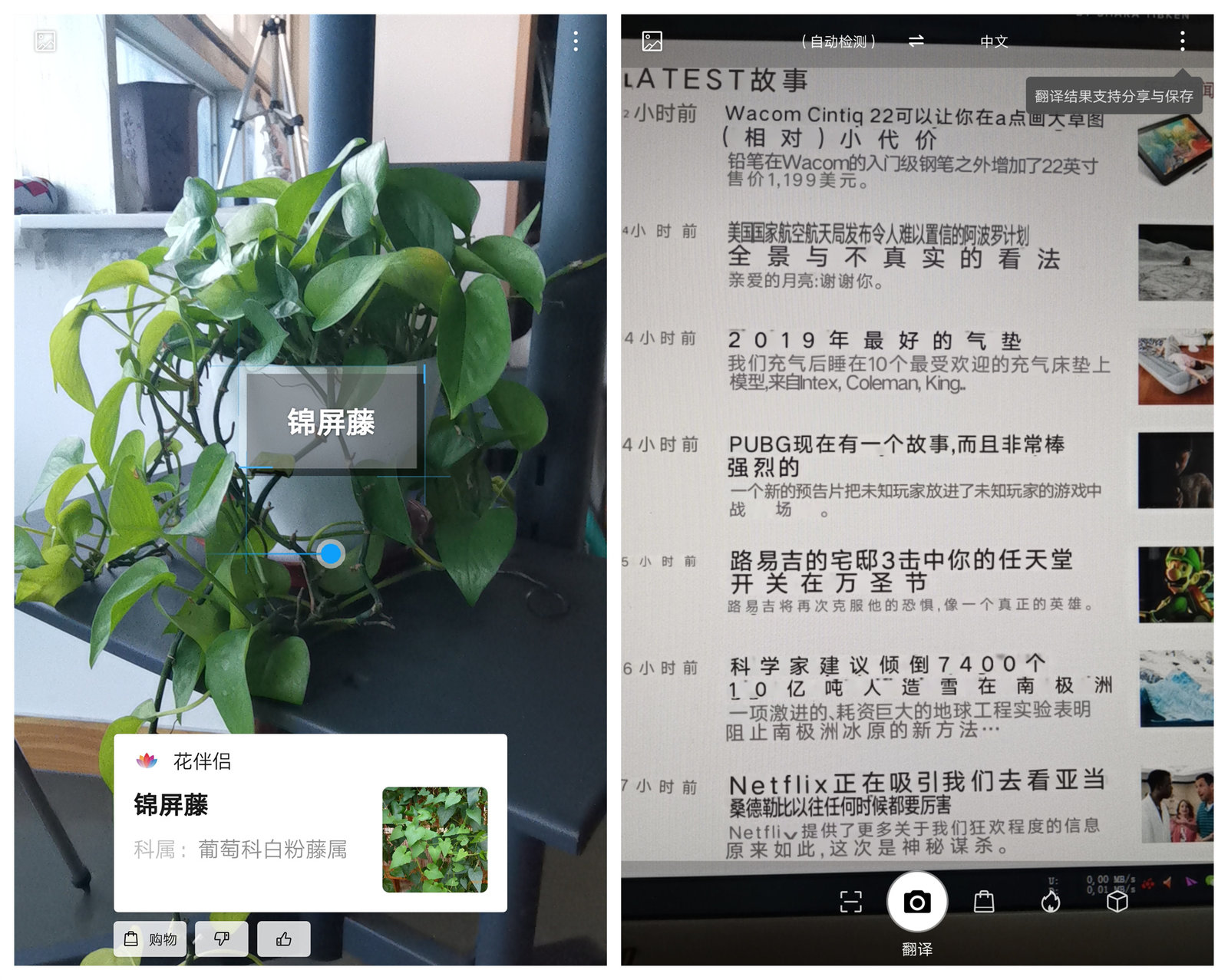

In addition, thanks to the efforts of the Commercial Press, the 12th edition has been published synchronously for the first time. The market version has two-dimensional codes on all pages of the text, which can directly access the interface of "Xinhua Dictionary APP" through mobile phone code scanning and enjoy multimedia knowledge services.

As the editing unit of Xinhua Dictionary, we are well aware that this small dictionary bears the initial heart of the predecessors, the mission of the present and the hope of the future. We will, as always, make every revision with a high sense of responsibility for the country and the people, keep pace with the times and contribute the highest quality dictionaries, and live up to the word "Xinhua" in Xinhua Dictionary, so that it will last forever and enjoy a good reputation throughout China!

(Author: Liu Danqing, former director of the Institute of Linguistics of China Academy of Social Sciences, director of the revision of the 12th edition of Xinhua Dictionary)