Statistics show that Guoxin Investment Co., Ltd. (hereinafter referred to as "Guoxin Investment") increased its holdings of some A-share listed companies before the Spring Festival in 2024. The reporter of Securities Times E Company noticed that Guoxin Investment is a wholly-owned subsidiary of China Guoxin Holdings Co., Ltd. (hereinafter referred to as "Guoxin Holdings"), which is known as the "new national team".

According to China Software (600536), as of February 6, Guoxin Investment held 7,457,500 shares of the company, accounting for 0.87%, making it the fourth largest shareholder of the company.

According to the report of China Software in the third quarter of 2023, by the end of the reporting period, Guoxin Investment held 5,478,100 shares of the company, accounting for 0.64%, making it the fifth largest shareholder of the company.

This shows that since the fourth quarter of last year, Guoxin Investment has accumulated 1,979,400 shares of China Software. Based on the interval weighted average price of China Software from October 9, 2023 to February 6, 2024 of 34.35 yuan, Guoxin invested about 68 million yuan.

As of the close of the last trading day before the Spring Festival (February 8), Guoxin Investment still holds 7,457,500 shares.

Enterprise investigation shows that Guoxin Investment was established in December 2015 with a registered capital of 100 million yuan, which is 100% owned by Guoxin Holdings. Guoxin Investment holds more than 40 A-share listed companies. The positions of the company are mainly blue-chip stocks such as China Petroleum (601857)(601857), China Petrochemical (600028)(600028), CNOOC China (600938) and COSCO Haikong (601919).

Guoxin Holdings, established on December 22, 2010, is one of the central enterprises under the supervision of the State Council State-owned Assets Supervision and Administration Commission. In early 2016, it was identified as a pilot of state-owned capital operation companies by the the State Council State-owned Enterprise Reform Leading Group. In December 2022, it was officially transferred from the pilot to the stage of continuous deepening reform.

By the end of 2022, the total assets of Guoxin Holdings were nearly 860 billion yuan; The net profit in 2022 was nearly 24 billion yuan.

Previously, Guoxin Holdings announced on December 1, 2023 that its Guoxin Investment increased its holdings of the CSI Guoxin Central Enterprise Technology Leading Index ETF and the CSI Central Enterprise Innovation Driving Index ETF, and stated that it would continue to increase its holdings in the future.

As of the close of the day, a number of ETF products showed heavy volume, such as the innovation-driven ETF of Boss Central Enterprises and the technology ETF of Southern Central Enterprises, which exceeded the turnover of the previous day several times; Huaxia CSI 300ETF and E Fund CSI 300ETF also launched several waves of heavy funds.

Now, Guoxin Investment should not only buy index funds at that time, but also "protect the market" by buying stocks of listed companies.

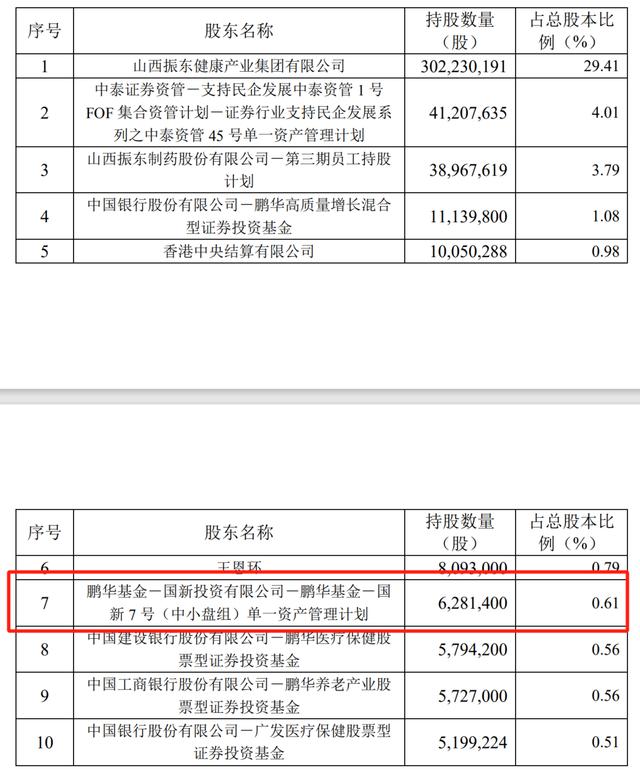

In addition to China Software, Guoxin Investment also intervened in Zhendong Pharmaceutical (300158)(300158). The announcement of Zhendong Pharmaceutical after the closing on February 7th shows that as of February 5th, Penghua Fund-Guoxin Investment-Penghua Fund-Guoxin No.7 (small and medium-sized group) holds 6,281,400 shares of the company’s stock, with a shareholding ratio of 0.61%, making it the seventh largest shareholder of the company. By the end of the third quarter of 2023, the above products had not entered the list of the top ten shareholders of Zhendong Pharmaceutical.

In addition, Guoxin Investment increased its holding of 9,435,400 shares of China Tungsten Hi-tech (000657)(000657) in the fourth quarter of last year. In November 2023, Guoxin Investment spent 600 million yuan to participate in the increase of Yihualu (300212)(300212).

This article first appeared on WeChat WeChat official account: E Company. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.

关于作者