Text |DoNews Zhang Yu

Editor | Yang Bocheng

As the largest Chinese online literature platform in China, Reading Group still failed to completely reverse its performance decline.

According to the 2023 financial report, the total revenue of Reading Group was 7.012 billion yuan, down 8.0% year-on-year; The net profit of returning to the mother was 805 million yuan, a year-on-year increase of 32.3%; Under non-GAAP, the net profit returned to the mother was 1,130.4 million yuan, down 16.2% year-on-year.

On the surface, although the total revenue of Yuewen Group decreased year-on-year, its net profit increased by more than 30%. However, it should not be ignored that its net profit growth was based on the decline of more than two-thirds in 2022. At the same time, the number of employees of Yuewen Group decreased by about 100 in 2023, which improved the operational efficiency to a certain extent, but also triggered doubts about the growth potential of Yuewen Group in the capital market.

On the second day after the release of the financial report in 2023, the share price of Reading Group plummeted at the opening, and the final closing price was HK$ 25.35, a decrease of 7.31%. Compared with the highest market value of HK$ 31.316 billion in the year, the market value of over HK$ 5 billion has vanished.

Reading Group revealed in its 2023 financial report that it has made innovations and explorations in many different fields, such as AIGC and short play market, etc. But can these explorations restore the reading group to its former glory?

01 lack of performance growth

In 2022, the total revenue of Reading Group declined for the first time in five years since its listing. The 2022 financial report shows that the total revenue of Reading Group is 7.63 billion yuan, down 12% year-on-year; The net profit was 608 million yuan, a year-on-year decrease of 67.1%.

By 2023, this situation has not improved, and the total revenue of Reading Group has dropped by 8.0% year-on-year. In fact, if the comparison time is prolonged, the performance of Reading Group seems to have bid farewell to the period of rapid growth. From 2017 to 2021, the total revenue of Reading Group was 4.095 billion yuan, 5.038 billion yuan, 8.348 billion yuan, 8.526 billion yuan and 8.668 billion yuan respectively, and the corresponding net profit was 563 million yuan, 912 million yuan, 1.112 billion yuan,-4.500 billion yuan and 1.843 billion yuan respectively.

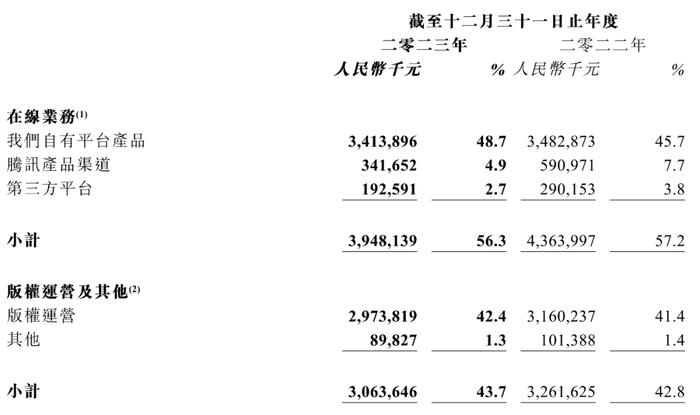

According to the business composition, Reading Group mainly has two businesses: online business, copyright operation and other businesses. The former mainly includes the income from online reading, online advertising and the distribution of third-party online games on the platform, while the latter mainly includes the income from the production and distribution of TV dramas, online dramas, animations, movies, selling copyrights, operating self-operated online games and selling paper books. Among them, online business is the main source of income for the Reading Group, and in 2023, this business accounted for 56.3% of the total revenue.

Source: Reading Group Financial Report

According to the 2023 financial report, the online business income of Yuewen Group was 3.95 billion yuan, a year-on-year decrease of 9.5%, among which the income of its own platform products, Tencent channels and third-party platforms all declined.

Specifically, the business income of self-owned platform products was 3.414 billion yuan, a year-on-year decrease of 2.0%, mainly due to the fact that Reading Group continued to optimize the distribution channels with low return on investment and improve the operational efficiency of online reading business; Tencent’s product channel business income was 342 million yuan, down 42.2% year-on-year, mainly due to the measures taken by Reading Group to optimize the content distribution mechanism, which led to the decrease in advertising revenue, and also due to the reasons why Reading Group optimized Tencent’s product distribution channels. The third-party platform business income was 193 million yuan, a year-on-year decrease of 33.6%, mainly due to the suspension of cooperation with some third-party distribution partners by Reading Group in 2023.

In addition, the revenue from copyright operation and other businesses was 3.06 billion yuan, down 6.1% year-on-year, which also showed a downward trend. Among them, the revenue from copyright operation decreased by 5.9% year-on-year, mainly due to the decrease in revenue of Xinli Media.

Along with the decline of all businesses, the number of active users has declined. According to the financial report, the monthly active users of Reading Group decreased from 244 million in 2022 to 206 million in 2023, with a decrease rate of 15.7%. Among them, although the average number of monthly paying users of Reading Group increased by 10.13% year-on-year to 8.7 million, ARPU (average monthly income per paying user) decreased by 14.0% year-on-year to 32.5 yuan. According to the financial reports over the years, from 2019 to 2022, the average monthly paid users of Reading Group were 9.8 million, 10.2 million, 8.7 million and 7.9 million respectively, while the ARPU was 25.3 yuan, 34.7 yuan, 39.7 yuan and 37.8 yuan respectively.

It is not difficult to find that in recent years, the average number of monthly paying users of Reading Group has generally declined, which means that the ceiling of paid reading looms, while copyright operation and other businesses are still difficult to carry the banner of income, and Reading Group is facing an extremely severe situation.

02 AIGC difficult rescue field

In July, 2023, Yuewen Group launched a large-scale model for online literature "Yuewen Miaobi" and an application product based on this model "Writer’s Assistant Miaobi Edition". Among them, Yuewen Miaobi mainly serves creators, providing services such as assisting people’s design, world outlook and power system construction.

AIGC is regarded as a new opportunity by Reading Group. In 2023, the ingenious version of the writer’s assistant has been opened to all contracted writers, and the weekly utilization rate of the AI function in the writer’s assistant has reached 30%.

Reading Group pointed out in its 2023 financial report, "With the continuous breakthrough of AI technology, we believe that AI can not only serve IP creation, but also play an important role in releasing the value of IP, which can bring adaptation opportunities for more works and shorten the path of IP from visualization to commercialization."

Hou Xiaonan, CEO and President of Reading Group, believes that in the future, Reading Group will continue to upgrade to an open and multi-modal model, and AIGC will fully empower the creative ecology and IP ecology. Reading Group will comprehensively explore the AI application of audio, comics, animation, derivative and other development chains.

AIGC is considered as the "secret weapon" for Reading Group to change the commercialization dilemma. Hou Xiaonan said, "AI translation can reduce the translation cost to 1%. Our long-term goal is to realize the one-click access of domestic writers to the sea, and even realize the global synchronous update of web texts in the future, which will help us build a global IP, and AI will reshape the business model of the entire IP industry chain. "

The 2023 financial report shows that WebNovel, the overseas reading platform of Reading Group, provides about 3,800 Chinese translations and about 620,000 local original works to overseas users. In March, 2023, among the top 100 works in WebNovel bestseller list, 21 works were translated by AI.

In the long run, although AIGC will help the Reading Group to build a new IP upstream and downstream integrated ecosystem, it is still difficult to change the status quo of the Reading Group at this stage: on the one hand, there are multiple problems in the process of promoting the industrialization of large models, such as computing power constraints, uneven data quality, and difficulty in highly integrating with the industry; On the other hand, large-scale model products are also faced with the homogenization of content. At present, the homogenization of online content has become more serious. Under the AI-assisted creation, similar themes are proposed to set similar world views and characters, or the homogenization problem is aggravated.

03 bet on the 100 billion short play market

Short plays are setting off a new wave of gold diggers. Ai Media Consulting predicts that the short play market will exceed 50.4 billion yuan in 2024 and 100.6 billion yuan in 2027.

The reading group, which holds a large number of high-quality IP, obviously doesn’t want to miss this outlet. In October, 2023, Reading Group publicly issued a script solicitation order, marking its official entry into the online text industry; In December, at the opening ceremony of the 2nd Shanghai International Network Literature Week, Yuewen Group released the "Star River Incubation Plan for Short Plays", which included three major initiatives: 100 IP cultivation plans, 100 million creative funds and AIGC empowerment. According to the 2023 financial report, there are several short plays in the Reading Group that have exceeded 10 million.

Hou Xiaonan believes that the short drama market is growing very fast, which constitutes a "new consumption model". The reading IP has also been adapted into short dramas, and the IP suitable for short drama adaptation will be screened out later to create short drama explosions.

Reading Group is indeed the closest player to the short drama track: on the one hand, reading group is in the content production link and plays the role of copyright owner, and short drama companies can cooperate with it to purchase copyright and incubate IP; On the other hand, Yuewen Group has a large number of young users, accounting for more than half of the age range of 19-35. In terms of audience groups, Yuewen Group has inherent advantages.

However, at present, the short drama industry is facing increasingly strict supervision. Since the end of November 2022, the State Administration of Radio, Film and Television has organized a special rectification work for "small programs" network short dramas. In 2023, the State Administration of Radio, Film and Television also carried out related actions twice. Subsequently, three short video platforms, WeChat, Tik Tok and Aauto Quicker, banned a large number of accounts that illegally published short plays. While a large number of miniseries were removed from the shelves, the industry also ushered in a crossroads.

In addition, it is not easy for Yuewen Group to enter the short play business: on the one hand, the content homogenization of short plays is more serious, and many short plays are similar in content, theme and form, lacking innovation and characteristics; On the other hand, the single profit model is a big dilemma of short plays. Many short plays mainly rely on advertising revenue and fans’ rewards, but these revenues are often not enough to support the long-term operation of the business.

With the continuous development of the short drama market, more and more players will flood into this field. In the case of fierce competition, it will be an important challenge for Reading Group in 2024 to carry out short drama business legally and legally and launch high-quality short drama products.

关于作者