CCTV News:On June 11th, the third issue of "China ‘ Shuangchuang ’ The Financial Index (hereinafter referred to as IEFI) was officially released at the 2019 Chengdu Global Innovation and Entrepreneurship Fair.

Combining with the financial demand characteristics of innovation and entrepreneurship activities, IEFI selects 57 evaluation indicators from five dimensions: innovative financial institutions, innovative financial services, innovative financial performance, innovative financial policies and innovative financial ecology, and combines qualitative and quantitative evaluation to systematically evaluate the development of financial support for innovative undertakings in 31 financial center cities in China. The first issue of IEFI was released in 2017, and it will be released once a year thereafter.

Judging from the comprehensive strength evaluation, Beijing, Shenzhen and Shanghai continue to lead China’s "double innovation" financial development, but the growth momentum has slowed down.

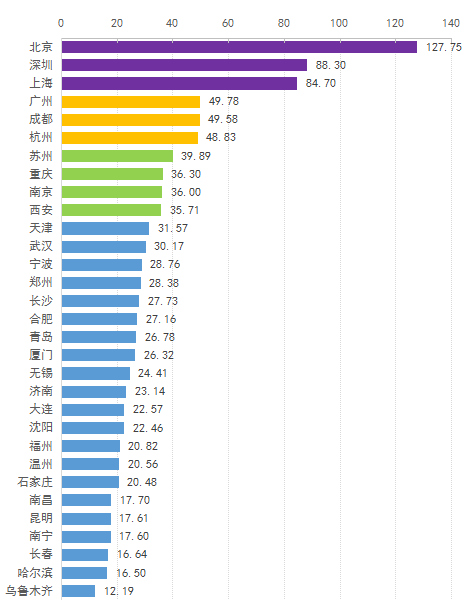

Comparison of Comprehensive Scores of 31 Cities in the Third "Double Innovation" Financial Index

The comprehensive ranking results of the innovative financial development of 31 financial center cities in this period are shown in Figure 1. The top ten cities are Beijing, Shenzhen, Shanghai, Guangzhou, Chengdu, Hangzhou, Suzhou, Chongqing, Nanjing and Xi ‘an. Beijing, Shenzhen and Shanghai continue to stabilize the leading position of "double innovation" financial development. Both the strength and breadth of financial support for "double innovation" and their own "double innovation" foundation and strength are benchmarks for domestic urban development.

From the perspective of comprehensive strength growth, the top three cities with increased scores are Chengdu, Xi ‘an and Beijing. Among them, Chengdu ranked first in the growth of comprehensive scores in this period, and grew rapidly for two consecutive years, surpassing Hangzhou in one fell swoop and ranking fifth in the country. Xi ‘an was the champion of scoring growth in the previous period. In this period, as the runner-up of scoring growth, it achieved rapid rise and ranked among the top ten in China for the first time.

Judging from the overall growth momentum, after the rapid growth in 2017, the financial development momentum of "double innovation" in domestic cities slowed down in 2018, especially in leading cities such as Shanghai and Shenzhen. The reason is that, on the one hand, the IPO in the domestic stock market slowed down significantly in 2018, and the number of companies listed on the New Third Board dropped sharply, which led to the poor performance of indicators such as "double innovation" financial performance; On the other hand, due to the trade friction between China and the United States, economic deleveraging, and rectification of financial chaos, the activity of innovation and entrepreneurship has declined from the previous year.

The regional imbalance of "double innovation" financial institutions has intensified, and resources have accelerated the gathering of Xiang Jing, Shanghai, Shenzhen and Hangzhou.

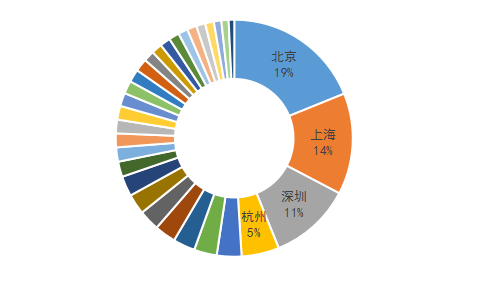

The "double innovation" financial institutions mainly evaluate angels, VC, PE, banking institutions and local financial service institutions, which are closely integrated with the "double innovation" activities. The top ten sub-projects are Beijing, Shanghai, Shenzhen, Hangzhou, Tianjin, Guangzhou, Chengdu, Nanjing, Chongqing and Wuhan. Among them, the resources of private equity institutions and local financial services institutions in the top four cities in the sub-list account for nearly half of the total of 31 cities (as shown in Figure 2).

Indication of sub-item score distribution of "double innovation" financial institutions

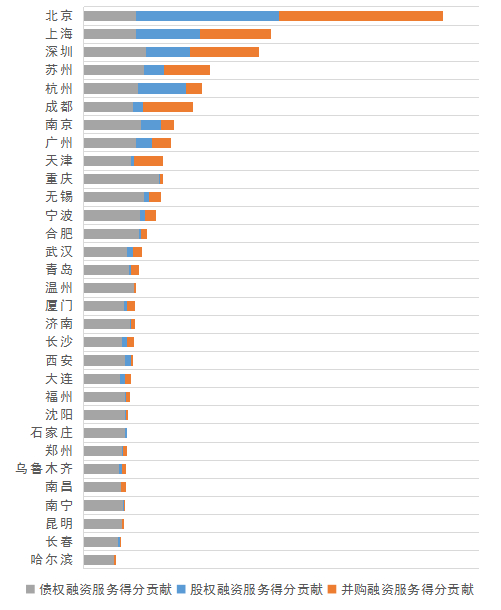

Debt financing is still the main way of "double innovation" financial services.

"Shuangchuang" financial services are used to evaluate and reflect the financial industry’s support for the demand for financial services of "Shuangchuang" activities, including equity financing services, merger and acquisition services and debt financing services. The top ten in this sub-item are Beijing, Shanghai, Shenzhen, Suzhou, Hangzhou, Chengdu, Nanjing, Guangzhou, Tianjin and Chongqing. Among them, the two cities with the largest increase in this sub-item score are Suzhou and Chengdu, both of which rank among the top ten in one fell swoop; The city with the fastest rise in sub-categories is Hefei, which rose by 9 places and ranked 13th. The M&A services in Suzhou and Chengdu have greatly increased, and Hefei has made great progress in supporting the "double innovation" activities with small loans.

From the perspective of financing structure, only six cities, including Beijing, Shanghai, Shenzhen, Suzhou, Hangzhou and Chengdu, have contributed more than 50% to the "double innovation" financing services, while the other 25 cities mainly rely on debt financing services. More than half of the scores of these 25 cities are contributed by debt financing services, and the equity financing and M&A services that most cities can provide are minimal, far from meeting the financial needs of the development of local "double innovation" undertakings.

Sub-item Score Structure of Dual-innovation Financial Services in Cities of the 3rd IEFI

Regional equity trading market plays an important role in improving the financial performance of urban "double innovation"

The financial performance of "double innovation" is mainly through the evaluation of the direct results of financial support for "double innovation" activities in the region, including the listing of GEM, the listing of the New Third Board, the listing of regional equity markets and the results of double innovation. The top ten in this sub-item are Beijing, Shenzhen, Shanghai, Guangzhou, Hangzhou, Wuhan, Chengdu, Changsha, Ningbo and Xiamen. The biggest improvement in the sub-item ranking is Zhengzhou, which rose by 5 places and jumped to 13th place in the country. The number of listed companies in Zhengzhou regional equity market has increased significantly.

The "double innovation" financial policy continued to be optimized, and there were more cities that attacked.

The financial policy of "double innovation" is a newly introduced evaluation dimension in this issue. It reflects the government’s guidance and support for "double innovation" finance by evaluating the support policies for the development of financial institutions, the guidance and support policies for financial services and the promotion policies for the optimization of financial ecology. The top ten sub-items are Chengdu, Shenzhen, Beijing, Guangzhou, Dalian, Shanghai, Xiamen, Nanjing, Suzhou and Zhengzhou. Among them, Chengdu ranks first in policy support, and it is a model city in China that uses policies to guide financial support for the development of "double innovation". The greater the support of the "double innovation" financial policy, the more significant the support effect on the activity of innovation and entrepreneurship, as shown in Figure 4. Dalian, Xiamen and Zhengzhou in the top ten cities in the sub-list have not entered the top ten comprehensive rankings, indicating that it takes some time for the policy effect to appear, and it is also crucial for the policy to really fall.

The Relationship between Financial Policy Support of "Double Innovation" and Activity of Innovation and Entrepreneurship

The financial ecology of "double innovation" has generally improved, and the leading edge of the top three is no longer prominent.

The "double innovation" financial ecology mainly evaluates the effectiveness of the city in supporting the external environment of "double innovation" financial development, including the activity of innovation and entrepreneurship, the support of double innovation talents, and financial intermediary services. The top ten sub-projects are Beijing, Shenzhen, Shanghai, Guangzhou, Chengdu, Xi ‘an, Chongqing, Hangzhou, Suzhou and Zhengzhou. Beijing surpassed Shenzhen for the first time and won the top position in this ranking. Shenzhen and Shanghai continue to maintain the top three positions in this ranking, but their leading edge has obviously narrowed. Xi’ an and Chengdu are the most significant cities in the optimization and improvement of "double innovation" financial ecology, and their scores increased by more than 50% in this period. In addition, Chengdu, Guangzhou, Chongqing and Zhengzhou also have significant score growth, and they are the leaders in the creation of "double innovation" financial ecology.

For the first time, the top ten list of "double innovation" financial items was selected, and Jingshen Suirong entered all six lists.

In this issue, IEFI also made an in-depth excavation of the characteristics and highlights of the "double innovation" financial development in 31 cities, and selected a series of top ten cities in key areas with high social concern. Among them, Beijing, Shenzhen, Guangzhou and Chengdu included six top ten lists. The complete list of the top ten cities in six areas in this issue is as follows:

Top ten cities with equity investment strength:Beijing, Shanghai, Shenzhen, Hangzhou, Guangzhou, Suzhou, Ningbo, Tianjin, Chengdu and Nanjing. Among them, the number and scale of private equity institutions in Hangzhou ranked fourth in the country, reaching 1,598 in 2018, and the total fund management scale was 89.6 billion US dollars, second only to Beijing, Shanghai and Shenzhen.

Top ten cities with equity financing scale:Beijing, Shanghai, Shenzhen, Suzhou, Hangzhou, Chengdu, Guangzhou, Nanjing, Tianjin and Wuxi. In 2018, the total scale of equity financing in Chengdu reached 158.4 billion yuan, of which the scale of mergers and acquisitions was second only to Beijing and Shenzhen, ranking third in the country.

Top ten cities with listed companies:Beijing, Shenzhen, Shanghai, Guangzhou, Hangzhou, Wuhan, Changsha, Chengdu, Xiamen and Ningbo. In addition to the first-tier cities in Shenzhen and Guangzhou, the number of enterprises listed in the regional equity exchange market in Hangzhou is significantly ahead of other cities, reaching 2429 at the end of 2018.

Top Ten Cities with Strong Policy Support:Chengdu, Shenzhen, Beijing, Guangzhou, Dalian, Shanghai, Xiamen, Nanjing, Suzhou and Zhengzhou. Chengdu has the largest support in the development support policy of dual-innovation financial institutions and the guidance support policy of dual-innovation financial services in China, while Shenzhen has the largest support in the promotion policy of dual-innovation financial ecological optimization.

Top Ten Cities with Active Innovation and Entrepreneurship:Beijing, Shenzhen, Shanghai, Xi ‘an, Guangzhou, Chengdu, Chongqing, Hangzhou, Suzhou and Qingdao. Among them, the number of newly established market entities in Xi’ an reached a record 543,000 in 2018, ranking first in the country; Chengdu ranks first in the country in terms of innovation and entrepreneurship, and Baidu’s hot search index has reached 55,902. At the same time, the number of newly established market entities in that year has reached 541,000, which is almost the same as that of Xi ‘an, which ranks first.

Top Ten Cities with Innovative and Entrepreneurial Talents:Guangzhou, Chengdu, Chongqing, Zhengzhou, Shenzhen, Xi ‘an, Wuhan, Hangzhou, Beijing and Changsha. Among them, Shenzhen, Guangzhou and Xi ‘an were the three cities with the largest net population inflow in 2018, all exceeding 400,000. Relatively speaking, Beijing is the only city among the top ten cities with a net outflow of population, with a decrease of 165,000 people in the whole year.

Chengdu’s "double innovation" finance surpassed Hangzhou and ranked fifth in the country, with distinctive development characteristics.

Chengdu started early in the exploration of "double innovation" and "financial innovation", and established a science-based franchise branch as early as 2009. Since Premier Li Keqiang put forward the idea of "mass innovation and entrepreneurship" in 2014, Chengdu has implemented the innovation-driven development strategy, solidly promoted the leading action of innovation and entrepreneurship, and quickly became a highland of "double innovation" in western China. It has accelerated its pace in exploring the development of "double innovation" financial innovation and has formed a good development trend.

In this period, Chengdu ranked first among 31 cities, and maintained rapid growth for two consecutive years, narrowing the gap with leading cities in one fell swoop, ranking fifth in the country, fourth among nine national central cities, third among 15 sub-provincial cities, and first in the central and western regions.

As the most representative city in terms of financial development and support level after Beijing, Shanghai, Shenzhen and Guangzhou, Chengdu’s successful experience has strong representativeness and reference significance in China. Summarizing the characteristics and highlights of Chengdu’s development, the most important point is that the government has spared no effort in promoting policy support and building financial service platforms. By integrating resources, it has built five financing service platforms for small and medium-sized enterprises and two financial ecological protection platforms (Chengdu Jiaozi Finance "5+2" platform), and has taken the lead in exploring and building a systematic, comprehensive and one-stop investment and financing service system for small and medium-sized enterprises in China, which has largely met the financial service needs of various innovative and entrepreneurial activities.

关于作者