Image source @ vision china

Text | Hugo Cross-border, Author | Dong Xinyi You Minfang

Domestic beauty brands have gone to sea, and now there is another "grassland" for planting grass.

According to late LatePost, in early 2020, ByteDance launched a product Lemon8 similar to Little Red Book in Japan. This product, which is defined as "community of interest in planting grass" in ByteDance, has been downloaded more than one million times, and it has begun to expand to Southeast Asian markets such as Thailand when the number of daily users is far lower than this.

If we carefully observe the label of Lemon8-"Community of Interest in Planting Grass", we can naturally think of the grand occasion of many domestic beauty brands "brushing the screen" on Little Red Book in recent years.

In fact, there are already domestic beauty brands that have registered official accounts on Lemon8.For example, in the case that the official account of Ke Laqi COLORKEY has not published the promotion content and 0 likes, the topic concern of COLORKEY has exceeded 2K.

Discussion on COLORKEY related topics on Lemon8 Source @Lemon8

Unintentionally inserted willows into the shade. Even some domestic beauty brands have not yet opened the official account of Lemon8, and they have already gained a lot of topic attention, and they are not very "out of the circle" brands such as Perfect Diary and Hua Xizi.

On Lemon8, the related topics of brands such as Feiluer FOCALLURE, Zise ZEESEA, and Flower Know Flower Know all have good attention, among which ZEESEA’s topic attention is particularly gratifying, with 69.9K.

Discussion on ZEESEA related topics on Lemon8 Source @Lemon8

This kind of relatively natural traffic also shows that these domestic beauty brands have been quite influential in overseas markets.According to the data released by the General Administration of Customs of China, the export value of beauty cosmetics and toiletries in China reached US$ 4.852 billion in 2021, with a year-on-year growth rate of 14.4%, which still maintained a strong growth.

Behind the domestic beauty brands getting together, Lemon8 is just a new springboard. So, how are these beauty brands going out to sea?

This paper will analyze five relatively emerging beauty brands, Feiluer, Zise, Tangduo, Huazhi and Ke Laqi, in an attempt to find out the differences and commonness of their brands.

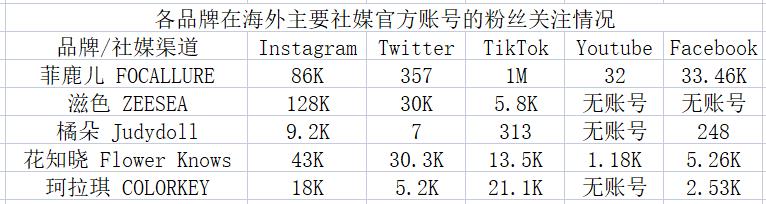

The soldiers and horses have not moved, food and grass come first, and social media marketing is the "ration" for the growth of beauty brands.There are huge differences in the sound volume of different domestic beauty brands and different social media overseas. To some extent, this difference has also accelerated the differentiation of these brands’ going to sea.

By counting the fans’ attention of five domestic beauty brands on Instagram, Twitter, TikTok, YouTube and Facebook. It can be found that these beauty brands have trade-offs in the choice of marketing channels.

Source @ Official of major overseas social media of all brands, as of March 27th, 2022.

Note: K stands for thousands and M stands for millions.

As the earliest brand among the five domestic beauty brands, Feiluer has gained more than 1 million fans in terms of the number of TikTok fans.Instagram and Facebook are its "second base areas", with 86,000 and 33,460 fans respectively, and they choose to strategically abandon Twitter and YouTube.

Zise’s "base camp" is on Instagram, with 128,000 fans. The interactive data is considerable, and the content of the comments is basically around the topics related to products such as color and product design. In addition, Twitter has more than 30,000 fans. In contrast, its TikTok has only more than 5,800 fans, which is a little thin. Fortunately, there is an external link on the homepage to place independent stations, which can directly jump to its independent stations.

Zise TikTok homepage image source @TikTok

Among the five brands, Juduo is a player with relatively weak social media layout.Its Instagram has more than 9,200 fans, while the layout of other social media has either not opened an official account or seems to be "paddling". However, the outer chain of Tangduo TikTok can switch to its six Shopee sites and Tmall.

Image source @ 京京京京京京京 online store

Hua Zhi is the only brand with "omni-channel" layout of social media, but it still focuses on Instagram, Twitter and TikTok, and the situation in Ke Laqi is similar.

CMO Sara, a Polaroid company that is responsible for exporting domestic beauty brands to Japan, once said that in terms of traffic conversion, the interaction rate of TikTok platform is as high as 5 to 18 times compared with Twitter, and the current conversion volume can reach 3% to 7%. [1]

The biggest commonality of these five brands is that almost all choose to give up YouTube strategically. The logic behind it is also well understood, just as few beauty brands in China are willing to invest a lot of energy and time in Youku. The fast-paced UCG (user-generated content) platform is often more popular with beauty brands, and it is easier to "plant grass".

In the choice of sea market, Southeast Asia market is the standard of these five brands.According to the latest market trend report of Mintel, a research and consulting company, Southeast Asia has been listed as the "future market" for the global cosmetics industry. It is estimated that by 2025, its market size will exceed 300 billion US dollars, with the growth potential of Indonesia, the Philippines and Thailand reaching more than 120%.

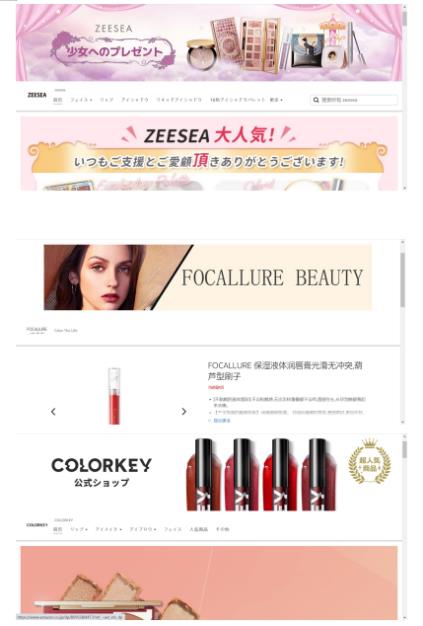

Except for Tangduo, almost all the other four brands chose Japan. In addition, Zise also laid out the American market.Generally speaking, the sales channels and playing methods of various brands are quite different.

In the aspect of Amazon site layout, Feiluer, Zise and Ke Laqi all have flagship stores of decorative brands in Amazon Japanese station, and all of them put in advertisements in the station. Hua knows that there is no advertisement in the station, and there is no brand flagship store. The orange flower has not settled in Amazon Japan Station.

Zi Se, Fei Luer, Ke Laqi’s Japan Amazon Flagship Store Page Source @ Amazon Japan Station

In addition, all five brands have settled in Shopee.It is worth mentioning that Feiluer’s millions of TikTok fan accounts are directly linked to Lazada, Whatsapp and Shopee through Linktree (a simple social marketing tool).

In terms of the layout of independent stations, the performance of the five brands is different.He Gu, the founder of ZBANX, vividly described the independent station in a cross-border interview with Hugo. "The independent station is an island, so don’t go to the island easily without fishing ability."

Tangduo is the most cautious of the five brands, and there is no independent station.Hua Zhi and Ke Laqi launched independent stations in Japan, and made a series of optimization for Japan. The homepage of Feiluer Independent Station mainly promotes the chameleon liquid eyeliner and supports payment in five currencies. Every order over $49 will be mailed nationwide, which is about the price of four liquid eyeliner pens.

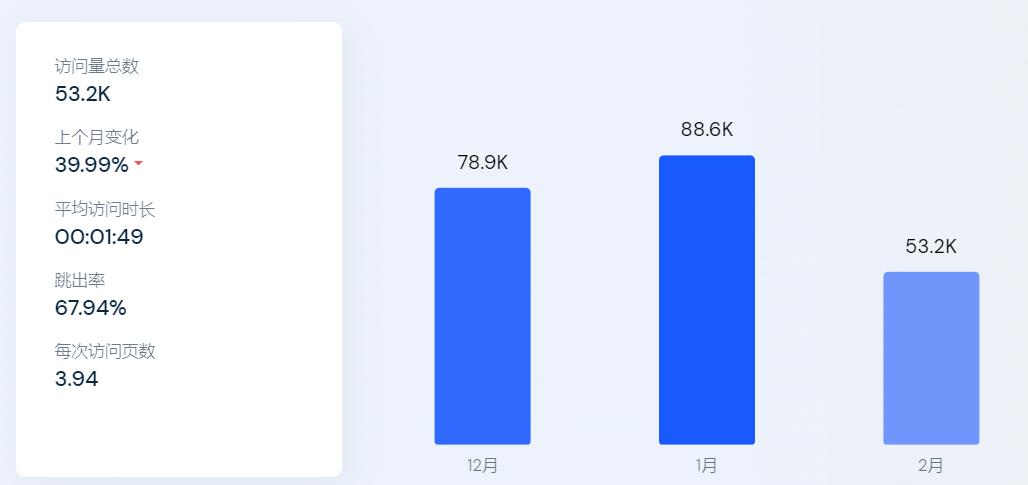

Among the independent stations of four brands, the only brand with a total visit of more than 50,000 in February 2022 was Zise. According to Similarweb data, the number of visits to zeeseacosmetics.com in February 2022 was 52,000, which was 39.99% lower than that in January, and the average visit duration was 1 minute and 49 seconds.

Zise Independent Station Traffic Data Source @Similarweb

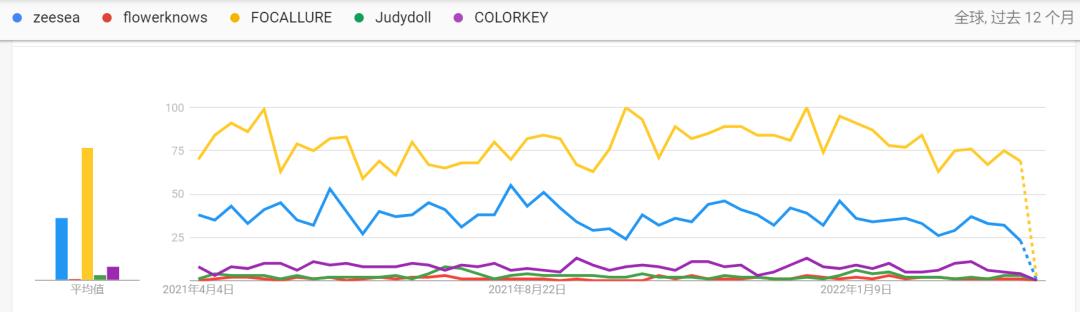

According to the specific data, the bounce rate of Zise Independent Station is 67.94%, which is much higher than the bounce rate of SHEGLAM, a beauty independent station owned by SHEIN, which is 31.12%, and the total number of visits is about one third of that of SHEGLAM31.12% 44.04% of the traffic on the PC side of Zise Independent Station comes from searching, and 33.07% comes from directly inputting the website of the independent station. Google Trends data shows that Feiluer and Zise have been ahead of the other three brands in the popularity of Google web search in the past 12 months.

In the past 12 months, the popularity of five beauty brands in Google’s web search data source @GoogleTrends

In terms of offline channels, Zise has settled in nearly 2,000 stores in Matsumoto Kiyoshi, Japan, and basically completed the closed-loop sales of online and offline channels. "When we entered Japanese social media for online marketing, Matsumoto Kiyoshi noticed us. Later, they took the initiative to find us to cooperate. It took us only one month to establish a long-term cooperative relationship, which is the fastest among non-Japanese brands."

He Jicai, director of Zise Marketing, once strongly valued the overseas offline market [2]. "Regardless of Japan or Europe and America, the offline proportion accounts for about 80%, and the e-commerce account for only 20%. Offline is a very big market. In Europe, we expect to enter offline Europe and North America at the end of the year, which will be our key markets. "

The positioning and origin of a beauty brand will greatly affect the brand’s products and supply chain, sales channels and promotion methods. After the brand successfully passed the stage from 0 to 1, these factors will interact with each other in the rapid growth stage, and together form a positive growth Mobius ring.

Most domestic beauty brands, such as Zise, Tangduo, Huazhi and Ke Laqi, started in the domestic market and then radiated overseas markets. On the contrary, Feiluer, who started as a foreign trade factory, is one of the earliest cross-border beauty sellers in China.

In the supply chain, all five brands adopt the mode of outsourcing.In the beauty industry chain, the gross profit margin of brands is the highest, reaching 60%-80%. According to the data of the National Cosmetics Record Network, among the five brands’ foundries, there are many three foundries that cooperate with Perfect Diary-Kosmeishi, Yingteli and Shanghai Zhenchen. [3] Many first-line brands at home and abroad are also partners of these three cosmetic foundries.

Data Source @ National Cosmetics Filing Network

Fang Xing, the co-founder of Feiluer, once introduced the growth path of the brand when interviewed by the media [4].

"In 2013, an export trading company in the cosmetics category was established, which was developed abroad in the form of cross-border e-commerce, but at that time it was only a simple supply chain export and product export; After accumulating a mature supply chain and experience in OEM with overseas brands, we created our own brand-Feiluer in 2016. With Haitao, a girl from China, bringing her brand back to China, Feiluer opened Taobao and Tmall stores for the domestic market. At present, the company has gained a firm foothold in many cosmetic brand categories. ".

In terms of the user portrait of Feiluer, Fang Xing said, "The early users of Feiluer are students and a new generation of white-collar workers. With the common growth of users and brands, brand labels change accordingly. In terms of price, pricing has risen, from the early 39 yuan/plate to 79 yuan/plate; User positioning: With the user’s age upgrading, it will be extended to married people. "

This growth path and user positioning make the portrait of Feiluer’s users in the domestic market very clear, and "student money" is still the third place in the keyword relevance of its Tik Tok content.The label related to "student" did not appear in the top ten of the content keywords of the other four brands.

Feiluer’s Tik Tok Content Keyword Relevance Ranking Data Source @ Huge Arithmetic

Note: The data are taken from the analysis based on Tik Tok’s content in a huge amount of calculation, and the data is taken from March 14th to March 20th, 2022.

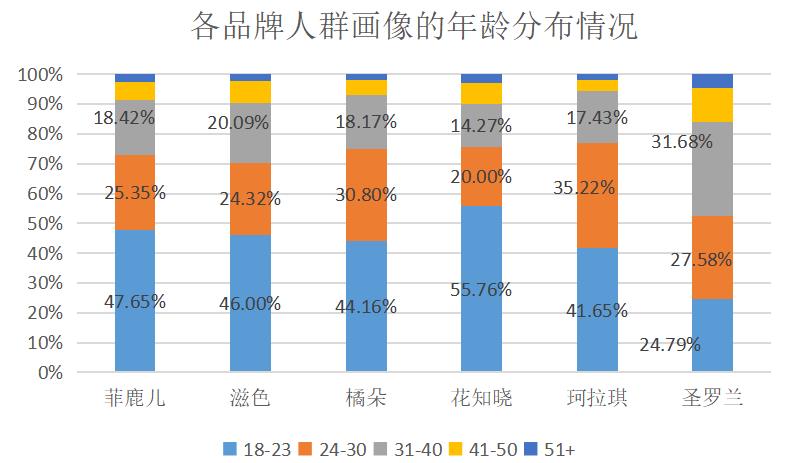

If we further focus on the portraits of "potential users" of various brands by age dimension.It can be found that the user portraits of these five brands in the domestic market are relatively "young". Especially under the background of Saint Laurent, this difference is closely related to product pricing and comprehensive tonality of brands.

Data Source @ Massive Calculation/Cartography @ Hugo Cross-border

Note: The data are taken from the analysis based on Tik Tok’s content in a huge amount of calculation, and the data is taken from March 14th to March 20th, 2022.

According to a huge amount of data, among the "potential users" known by Hua, the proportion of people aged 18-23 is as high as 55.76%, ranking first among six brands including Saint Laurent.

According to Yang Zifeng, co-founder of Hua Zhi, 15-25 years old is the user age range of Hua Zhi, accounting for 70%; Users aged 25-35 may account for about 30% [5]. "The reason why there are different age gradients is because women have a girl’s heart more or less."From this perspective, the brand positioning, product form and user portrait that Hua knows have become a whole.

Smell reason like enlightenment, and you will be lost when you meet the situation. In the era when traffic is king, many people try to explore the law of growth once and for all. However, the growth path of each brand is closely related to the industry environment, brand strategy and cash flow at that time.

From 2016 to 2021, the important conditions for the rise of emerging beauty brands in the domestic market are the rapid increase of e-commerce penetration and the prosperity of the "planting grass" platform. Fang Xing said, "At that time, the ratio of skin care and beauty makeup abroad was 3:7, while that in China was just the opposite. Before 2018, there was basically no concept of makeup. Until 2020, the volume of makeup was less than half compared with skin care, so the ceiling of the industry was very high. "

Now, for relatively mature domestic beauty brands, it may be a good choice to spread the "seeds" to the whole world instead of continuing to "roll in" at home.

References:

- Jumeili | Jumeili | Brand accelerates to go to sea, and C-Beauty goes to the world.

- Bright company | Beauty brand Zise’s decision to go to sea in Japan Small logic: Domestic content marketing going to sea is a blow to dimensionality reduction.

- Growth black box | 12000 words Comprehensive interpretation of the perfect diary: from organizational structure to growth strategy

- Graffiti Finance | Fei Luer Co-founder: The ceiling of the makeup industry is high, but the ceiling of the company may be very low

- National business daily | Building a differentiated barrier to beauty. Knowing the founder: Original design is the core competitiveness

关于作者