During the 13th Five-Year Plan period, the scale and intensity of China’s R&D investment (hereinafter referred to as "R&D investment") have steadily increased, but there is still a significant gap compared with the expected goal proposed in the 13th Five-Year Plan. During the "Fourteenth Five-Year Plan" period, it is necessary to formulate the target and supporting policies for the growth of R&D investment in light of the situation and needs faced by development.

First, the basic situation of R&D investment growth during the "Thirteenth Five-Year Plan" period

(1) The scale and intensity of R&D investment have steadily increased.

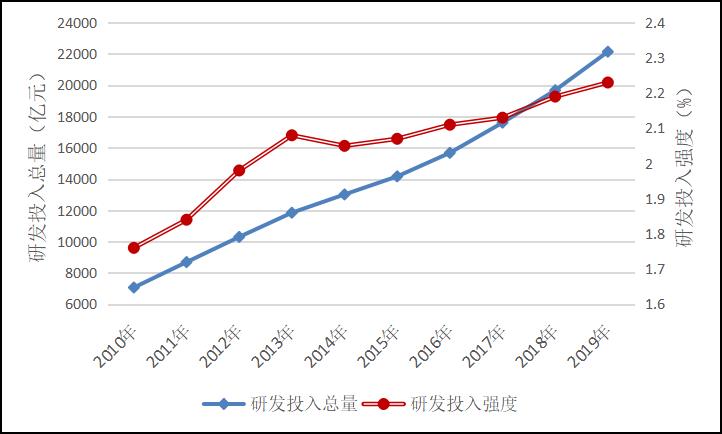

According to the Statistical Bulletin of National Science and Technology Investment, the total R&D investment in China reached 2.23 trillion yuan in 2019, an increase of 810 billion yuan compared with 1.42 trillion yuan in 2015, with an average annual growth rate of 11.8% in the Thirteenth Five-Year Plan; China’s R&D investment intensity reached 2.23%, 0.16 percentage points higher than 2.07% in 2015. (See Figure 1) By horizontal comparison, China’s total R&D investment has been ranked second in the world since it surpassed Japan in 2013, and China’s R&D investment intensity has exceeded the average level of 2.13% in the 15 EU countries, which is not far from the average level of 2.37% in OECD countries.

Figure 1 Total R&D expenditure and investment intensity in China from 2010 to 2019.

Source: According to the Statistical Bulletin of National Science and Technology Investment from 2010 to 2019.

(B) R&D funding structure further optimized.

The proportion of investment in basic research and applied research has increased. In 2019, the total investment in basic research in China reached 133.6 billion yuan, accounting for 6% of R&D funds, an increase of 0.9 percentage points compared with 2015; Applied research funds reached 249.9 billion yuan, accounting for 11.3% of R&D funds, an increase of 0.5 percentage points compared with 2015; The experimental development funds reached 1,831 billion yuan, accounting for 82.7% of the R&D funds.

The supporting role of research and development in colleges and universities has been enhanced. In 2015, the R&D expenditures of enterprises, government-owned research institutions and universities accounted for 76.8%, 15.1% and 7.0% respectively, and the R&D expenditures of universities were low. Since the "Thirteenth Five-Year Plan", the R&D expenditure of enterprises, government-owned research institutions and universities has increased by 11.7%, 9.6% and 15.8% annually, respectively, and the proportion in the national R&D investment has been adjusted to 76.4%, 13.9% and 8.1%, and the role of universities in innovation investment has been relatively enhanced.

The growth of R&D investment in the central and western regions kept catching up. From 2016 to 2019, the R&D investment in the eastern, central, western and northeastern regions increased by 11.0%, 15.9%, 13.3% and 4.9% respectively, and the central and western regions accounted for 30.4% of the national R&D investment, an increase of 3 percentage points compared with 2015.

(C) It is difficult to achieve the objectives of the 13th Five-Year Plan.

The goal of R&D investment intensity proposed in the "Thirteenth Five-Year Plan" is to increase by 0.4 percentage points in five years, and the R&D investment intensity will reach 2.5% by 2020. In 2019, the R&D investment intensity in China was 2.23%, and only 32.5% of the planned progress was completed in the first four years. Affected by the COVID-19 epidemic, the decline of R&D investment growth rate in China in 2020 may be greater than the decline of nominal GDP growth rate, which makes it more difficult for R&D investment intensity to reach the standard.

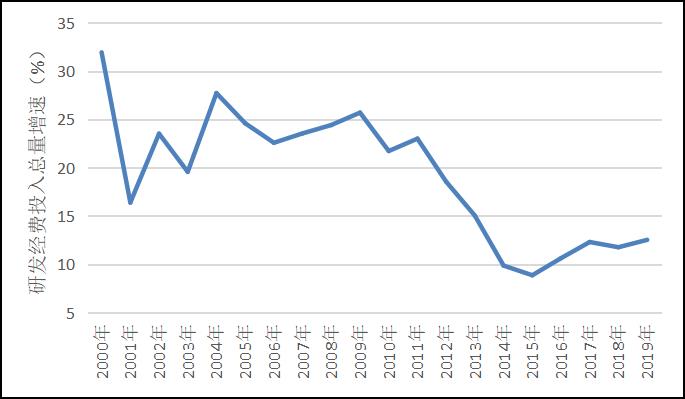

Figure 2 Growth rate of total R&D investment in China from 2000 to 2019

Source: According to Statistical Bulletin of National Science and Technology Investment.

The direct reason why the intensity of R&D investment during the Thirteenth Five-Year Plan period is difficult to meet expectations is that the growth rate of R&D investment has slowed down significantly after 2014. The main work of compiling the outline of the 13th Five-Year Plan was completed in 2014, and the average annual growth rate of R&D expenditure in China from 2000 to 2013 was as high as 22.7%. Extrapolating from this growth rate, with the nominal GDP growing at an average annual rate of 9.5% during the 13th Five-Year Plan period, the investment intensity of R&D funds in China can indeed reach about 2.5% by 2020. However, in 2014, the growth rate of R&D expenditure in China dropped sharply to 9.87%, and the average annual growth rate was only 11.8% after the 13th Five-Year Plan. (See Figure 2) The unexpected decline in the growth rate of R&D investment has led to the failure to complete the target of R&D investment intensity in the Twelfth Five-Year Plan and the difficulty in completing the target of R&D investment intensity in the Thirteenth Five-Year Plan.

Second, the "Thirteenth Five-Year Plan" period, the main factors affecting the slowdown in R&D investment growth

(A) The growth of R&D investment of enterprises slowed down significantly.

According to the main body of innovation activities, the R&D expenditure of enterprises accounts for more than 75% of the total R&D investment in the country, which is an important force supporting the growth of R&D investment. Compared with the "Twelfth Five-Year Plan" period, the average annual growth rate of enterprise R&D expenditure decreased by 4.3 percentage points during the "Thirteenth Five-Year Plan" period, which had a great impact on the growth of total R&D investment.

There are both cyclical factors and trend factors that lead to the slowdown of R&D investment growth. From the perspective of cyclical factors, the total profits of industrial enterprises increased by 4.5% annually during the Twelfth Five-Year Plan period, and decreased by 0.6% annually since the Thirteenth Five-Year Plan period. As the most important source of funds for enterprises’ innovation investment, the slowdown in profit growth will inevitably affect R&D investment. From the trend factor, with the changes of internal and external factors, the incentive of R&D investment of foreign-funded enterprises in China has been declining in recent years. During the "Twelfth Five-Year Plan" period, the R&D investment of domestic-funded enterprises, Hong Kong, Macao and Taiwan-invested enterprises and foreign-invested enterprises in the national industrial enterprises increased by 14.4%, 14.0% and 9.7% respectively. Since the "Thirteenth Five-Year Plan", the R&D investment of the three types of enterprises has increased by 9.8%, 4.7% and 4.5% annually, respectively, and the growth rate of R&D investment of enterprises invested by Hong Kong, Macao and Taiwan and foreign-funded enterprises has dropped significantly.

(B) Some technology-intensive industries’ revenue share and R&D investment growth slowed down.

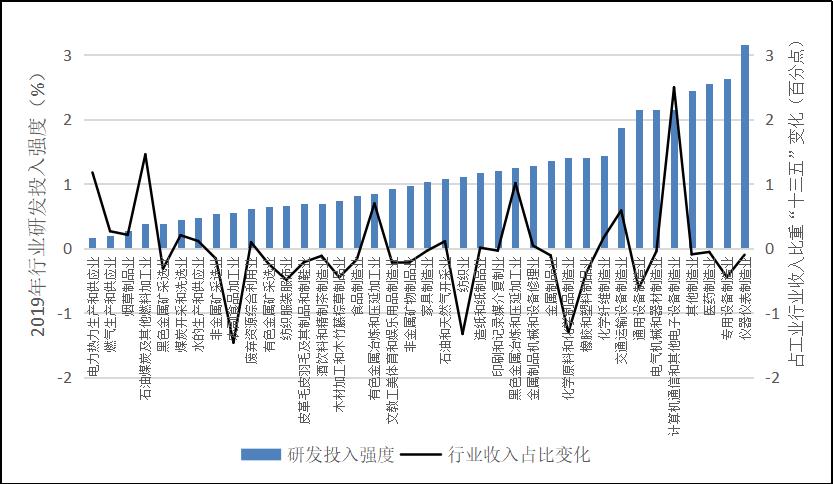

Industry is the industrial sector with the highest R&D investment intensity. Since the 13th Five-Year Plan, the industrial sector in China has undergone structural changes that are not conducive to the growth of R&D investment. As shown in Figure 3, the major industrial sectors are ranked according to the intensity of R&D investment from low to high, and compared with the changes in the proportion of income of all industrial enterprises in the "Thirteenth Five-Year Plan" period, it can be seen that the proportion of income of 9 of the 12 industries with R&D investment intensity higher than the average value of industrial sectors has declined, and the growth rate of R&D expenditure of transportation equipment manufacturing and chemical fiber manufacturing is also lower than the average value of industrial sectors. In the low-input industries, the income proportion of electric power and heat production and supply, oil, coal and other fuel processing industries, ferrous metal smelting and rolling processing industries has increased significantly. These changes will have a negative impact on the growth of R&D investment in the industrial sector.

Figure 3 Changes in the revenue structure of China’s industrial sector during the 13th Five-Year Plan period.

Source: According to Statistical Bulletin of National Science and Technology Investment.

(C) In some areas, the growth of R&D investment slowed down significantly under the downward pressure of the economy.

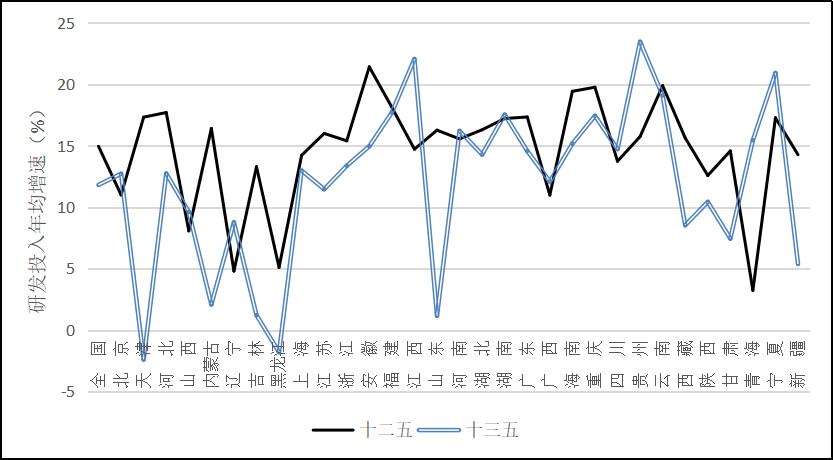

During the "Thirteenth Five-Year Plan" period, due to internal and external factors, some regional economies in China are facing greater downward pressure. Because innovation activities are more affected by economic prosperity than general economic activities, the growth of R&D investment in these regions has obviously slowed down. From 2016 to 2019, the growth rate of R&D investment in 20 provinces (autonomous regions and municipalities) in China decreased compared with the Twelfth Five-Year Plan period, among which the growth rate of R&D investment in seven provinces (autonomous regions and municipalities) including Tianjin, Inner Mongolia, Jilin, Heilongjiang, Shandong, Xizang, Gansu and Xinjiang decreased significantly. (See Figure 4) Among the seven provinces (autonomous regions and municipalities), the R&D investment in Tianjin and Heilongjiang is negative, while the R&D intensity in Shandong, Xizang and Xinjiang is declining, so it is difficult for these regions to achieve the goal of the "Thirteenth Five-Year Plan".

Figure 4 Comparison of the average annual growth rate of R&D investment in different regions during the 13th Five-Year Plan period and the 12th Five-Year Plan period.

Source: According to Statistical Bulletin of National Science and Technology Investment.

Third, the situation and requirements faced by the growth of R&D investment in China during the 14 th Five-Year Plan period

(A) There is still a big gap between the intensity of R&D investment and the scale of R&D investment in key industries in China and major countries.

Although China’s total R&D investment has reached the second place in the world, there is still a big gap between its R&D investment intensity and that of major developed countries. In 2017, the R&D investment intensity of the United States, Japan, Germany, South Korea and other countries reached 2.8%, 3.2%, 3.0% and 4.6% respectively, which were significantly higher than that of China (2.23%). In some key industries and emerging industries, the scale of R&D investment in China also lags far behind that in industrialized countries. According to the data analysis disclosed in the financial reports of relevant companies, in 2018, in the field of information technology, the annual R&D expenditures of Amazon and Google in the United States reached US$ 22.6 billion and US$ 16.2 billion respectively. In the same year, the total R&D investment of the top 100 Internet companies in China was only US$ 15.7 billion; In the biomedical industry, the annual R&D investment of Johnson & Johnson and Merck in the United States reached US$ 10.6 billion and US$ 10.2 billion, respectively. In the same year, the R&D expenditure of China pharmaceutical manufacturing industry was only US$ 7.9 billion. In the automobile industry, the annual R&D expenditures of German Volkswagen and Japanese Toyota were US$ 15.8 billion and US$ 10 billion respectively, and the R&D investment of China automobile industry in the same year was US$ 17.2 billion. China needs to make great efforts to continue to increase investment in R&D if it wants to catch up with technology and industry.

(B) China entered a new stage of development and put forward higher requirements for innovation investment.

According to the international comparison data of the United Nations, the current per capita physical capital stock of China is more than 40% of that of the United States. After years of catch-up, the gap between China and the United States in per capita capital stock of more than 40 times at the beginning of reform and opening up has been obviously narrowed. Accelerating the catch-up of technology and production efficiency to open up space for further capital deepening has become an urgent task for economic growth in the new stage. In 2019, China’s per capita GDP exceeded $10,000, which is about $2,300 away from the threshold of high-income economies. From the international experience, when the late-developing economies reach the high-income threshold, they often face greater structural transformation pressure and downside risks of economic growth. The key for China to avoid the rapid slowdown of economic growth before the high-income threshold and the decline or even retrogression of economic growth after crossing the high-income threshold lies in whether it can effectively improve the growth rate of total factor productivity and the contribution rate of scientific and technological progress, and smoothly realize the transformation of growth momentum. To achieve this goal, increasing investment in research and development is an important foundation.

(C) During the 14th Five-Year Plan period, the total demand was insufficient and the pressure of economic growth was still considerable.

When the growth rate of R&D investment remains unchanged, the slowdown of economic growth will "enhance" the intensity of R&D investment. However, from the experience at home and abroad, when the economic growth slows down, a country’s innovation activities will be greatly affected, and the growth rate of R&D investment tends to decline by a larger margin. If the slowdown in economic growth is mainly caused by the decline in potential growth rate, the impact on the general price level and corporate profits is limited, and it will even push up the price level and corporate profits. However, if the slowdown of economic growth is caused by the contraction of total demand, it will have a great impact on the price level and corporate profits. From the producer price index, enterprise profit growth rate, asset turnover rate of industrial enterprises and other indicators, China has suffered a strong demand-side impact since 2018, and the COVID-19 epidemic in 2020 has strengthened demand shocks, so the growth of China’s total demand during the 14th Five-Year Plan period is not optimistic. Under this circumstance, industrial enterprises and areas with difficulties in transition will continue to face greater economic pressure. To ensure the growth of R&D investment in these subjects and regions, more powerful measures must be taken to stabilize growth.

Four, the "Fourteenth Five-Year Plan" period to enhance R&D investment goals and ideas

(A) reasonably determine the "Fourteenth Five-Year Plan" R&D investment intensity target

Judging from the medium-term trends of supply side and demand side, China is expected to achieve an average annual GDP growth rate of about 5.5% during the Tenth Five-Year Plan period. If the GDP deflator remains at the average level in the past 10 years, the average annual growth rate of nominal GDP in China will reach about 8.3% during the Tenth Five-Year Plan period. For example, the R&D investment intensity in China will reach about 2.3% in 2020, with an average annual increase of 10% during the 14th Five-Year Plan period. In 2025, the R&D investment intensity in China can reach 2.5%, basically catching up with the expected target set in the 13th Five-Year Plan. Considering that the expected indicators should leave appropriate space, the intensity target of R&D investment during the "14th Five-Year Plan" period can be set at about 2.6%.

(B) to expand investment in research and development as an important means of countercyclical management

At present, the pressure of insufficient aggregate demand continues to increase, and the counter-cyclical regulation in China is generally moderate. One of the concerns that the current macroeconomic policy is difficult to exert is that the investment fields with high long-term return rate in China have obviously decreased compared with the past, especially the return on investment in infrastructure, real estate and other fields has dropped significantly. In this case, the strong stimulus policy has limited driving force for economic growth, and it will also increase financial risks. To change this dilemma, we need to break through the policy mindset. Innovation investment incentive policy is traditionally a long-term policy, but from the long-term return of the whole society, innovation undoubtedly has a high rate of return. At the same time, whether R&D investment is used to buy R&D equipment or to pay R&D personnel, it can form an extended consumer demand, thus generating a multiplier effect of demand expansion. Under the current situation, expanding R&D investment can be regarded as an important means of countercyclical regulation, which is not only conducive to stabilizing aggregate demand, but also conducive to long-term growth, and is a two-pronged strategy for both short-term stable growth and long-term quality improvement.

(3) Focus on increasing the proportion of investment in basic research

Compared with the major industrialized countries at similar stages of development, China’s current investment in basic research is obviously insufficient. In the process of rapid growth in Japan, the proportion of basic research investment in total R&D expenditure has remained above 20% for a long time. After the high-speed growth period, Japan entered a development stage similar to that of China, and began the process of "deindustrialization". Even so, the proportion of basic research investment in Japan has remained stable at 12%-16% for a long time. Long-term emphasis on basic research has greatly benefited Japan’s scientific and technological innovation, and the increasing number of people who have won Nobel Prizes in natural sciences in Japan is a concrete reflection. In recent years, China has paid more and more attention to basic research investment, but at present, the proportion of basic research investment is only 6%. In the future, in response to the technological blockade of becoming a big country, China should focus on catching up with the gap in basic research investment. From the investment subject, China’s basic research investment is mainly from the central government, while local finance and enterprise basic research investment are less. In the future, on the one hand, it is necessary to adjust the structure of fiscal expenditure on science and technology, increase financial investment in basic research, and guide enterprises to increase investment in basic research by increasing the income tax deduction ratio of basic research expenditure of enterprises.

(D) improve the pattern of industrial organization, and give full play to the main role of innovation of large enterprises.

Innovation investment has a strong scale effect. From the international and domestic experience, whether in traditional industries or emerging industries, the innovation incentive and innovation investment ability of large enterprises are generally higher than other enterprises. For example, in 2019, the R&D investment intensity of China iron and steel industry was only 1.25%, but the R&D investment intensity of baoshan iron & steel Company, as the industry leader, was as high as 3%. Since the financial crisis, the concentration of some industries in China has declined, which has adversely affected the industry’s innovation input incentives and capabilities. In the future, it is necessary to stabilize the growth of R&D investment of enterprises and give full play to the main role of enterprise innovation. It is also necessary to further promote the structural reform and deployment of the supply side in accordance with the deployment of the central government, and continuously improve the industrial organization pattern, so that the proportion of enterprises with high R&D investment intensity and the proportion of industries will continue to increase.

(The author Jia Shen is an associate researcher in the Development Strategy and Regional Economic Research Department of the State Council Development Research Center, and Wang Minghui is an associate researcher in the General Office of the State Council Development Research Center).

关于作者