The last master class of the 3rd Hainan Island International Film Festival was a dialogue between actors and directors.

The actor is Hao Lei, whom we are familiar with; The director is Alice Lowcher, who directed Happy lazaro and Miracle.

In this game called "Freud’s The Interpretation of DreamsIn the discussion of the theme, the two guests invited by the film media still presented many wonderful views and thought-provoking experiences.

Moderator: Good afternoon, everyone. Welcome to the master class of the 3rd Hainan Island International Film Festival.

I’m wangtong, the host of today’s event.

When the team gave me the theme of this activity planning, it was the analysis of the dreams projected on the screen.

The first sentence that popped up in my mind was the sentence in the Diamond Sutra: "Everything is like a dream bubble, like dew, like electricity, so we should look at it this way."

This sentence is quite clever, and it also pays attention to the film itself as a medium.

Because everything in the world or dream imagination is ever-changing.

As a very delicate medium, film can just carry this kind of reality and dream.

Today’s master class activity is actually the last heavy event of this film festival.

It’s an honor to inviteItalian director and screenwriter Alice LorvacheandTeacher Hao Lei, an actor.Take us into the dream of movies together.

I’d like to introduce two conversation guests first.

Directed by Alice LorwacherIt is a new force for Italian authors’ films.

Her first novel.EucharistBe short-listedDirector Cannes biweekly unit.

Later works[miracle]、[Happy lazaro]Are all shortlisted.Main Competition Unit of Cannes International Film Festival, respectively.Jury awardandBest screenplay award.

Her latest short film with French artist JR also premiered at the Venice International Film Festival in September.

The director’s works are always full of neo-realism and magic, and the two carriages are neck and neck, with light and smart pictures and characters.

Let’s enjoy the fascinating audio-visual language directed by Alice Lowcher through a short film.

The second part is to introduce excellent actresses.Teacher Hao Lei..

Since the film, she has easily portrayed and shaped many female images of different types and personalities in film, television and drama works, and has been nominated for the Golden Horse Award and other awards several times.[Picture 4] Won the Golden Horse Award for Best Supporting Actress..

Let’s learn about her wonderful performance in film and television works through a short film.

Due to the epidemic, director Alice Lorwacher failed to visit the film festival offline.

Now we ask technicians to invite her to the scene through video connection.

Please give a warm applause to welcome Mr. Hao Lei to the stage. Teacher Hao Lei would like to say hello to everyone first.

Hao Lei:Good afternoon, everyone. I’m glad to meet you here today.

Alice Lorwacher:Thank you very much. I am very happy to be here to meet you today.

Wangtong: We also prepared some questions for the two guests. A series of questions are very personal and private, and are closely related to the film.

Let me ask Mr. Hao Lei first, when did you first come into contact with movies, and what was your feeling at that time?

I first came into contact with movies when I was young.

Hao Lei:It’s too early, because when my mother was pregnant with me, there was a cinema next to our house.

She goes to the movies after work, and I think my ability to do this may have something to do with prenatal education.

Wangtong: What movie did Mom watch at that time?

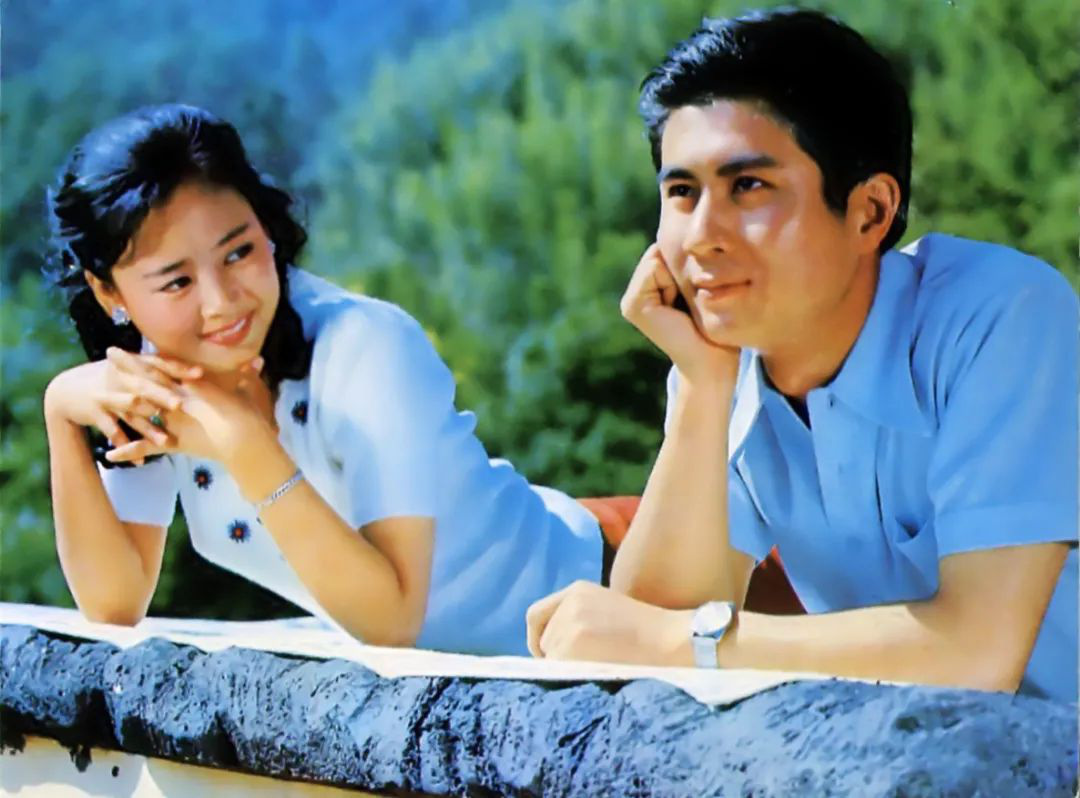

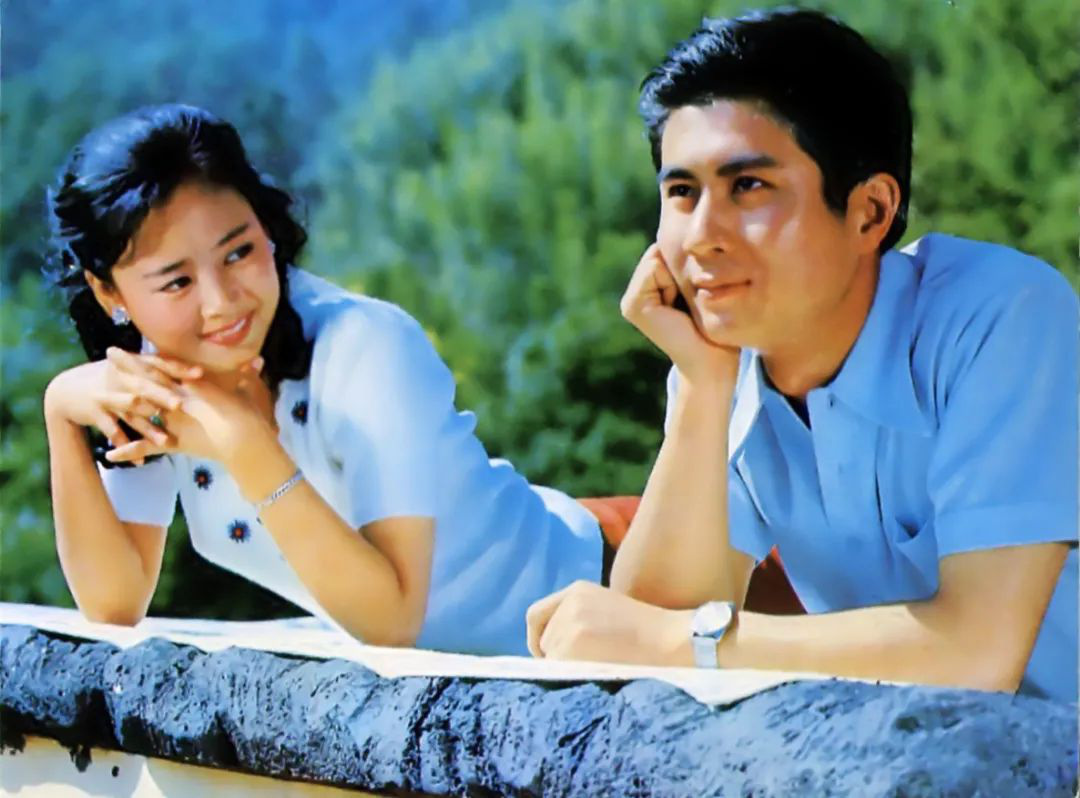

Hao Lei:In her day, for example,[romance on lushan mountain]These films.

Our family doesn’t do this line of work. I think that prenatal education may be really important.

Later, because I started to be a student in changchun film studio at the age of 15, I started to walk on at that time. At that time, there were not many TV dramas, all of which were movies.

I started to give a walk-on to all kinds of movies. I remember that the first walk-on was a film movie played by teacher Gong Hanlin, which seemed to be called [Magic Master], and I played a fan of idolize.

Wangtong: How did you feel at that time?

Hao Lei:I think it’s amazing because I don’t know the studio or even where the machine is.

It’s amazing how I appeared on the screen and didn’t understand the industrial process. It’s an amazing experience.

Wangtong: We know that director Alice Lowcher’s family is similar to yours, and it doesn’t seem to be particularly related to movies.

My father should be a beekeeper and my mother is a school teacher.

Director Alice Lowcher, when did you first come into contact with movies when you were a child, and how did you feel at that time?

Alice Lorwacher:When I first came into contact with the film, it was very young.

In our family, none of us is engaged in the film industry.

At that time, we lived in the country, that is to say, when we were young, we had no concept of movies.

When I first came into contact with movies when I was a child, I felt amazing when I first entered the cinema.

In the movie, music, images, everything, including your imagination, all appeared in one movie. For me, this discovery was really amazing at that time.

It feels like a celebration, which is a feeling that my first contact with the film gave me.

Wangtong: So for you, the age of 17 is an enlightenment for your film career.

Because when you were 17 years old, you saw a film that was of great significance to your career choice.

Alice Lorwacher:Of course, from that moment on, I thought that I was interested in movies, but it was still a distant thing for me to enter this industry.

Then I studied this classic literature, and at the same time I moved from the countryside to the city to live, so that I was closer to the film.

For me, as a profession, I chose it. I started with documentary.

I knew a family who made documentaries, and they told me this story, so I decided to make documentaries with them.

When I heard their stories, I not only wanted to tell the true story in a real way, but also wanted to add some artistic creation to it.

I also hope to convey more information through such a documentary form.

So I later started as a screenwriter and wrote such a script, which was later filmed [Eucharist], and my career took off from this story.

Wangtong: Seventeen years old is a particularly important age for director Alice Lowcher.

Mr. Hao Lei, for you, your first highly praised and concerned work was 17 years old.

seventeen no cryHow did you feel when you took a play like that? Were you determined to make a film, do film and television and do drama work?

Hao Lei:I started acting at the age of 15, and "Don’t cry at seventeen" was filmed at the age of 19.

Before I entered Shanghai Theatre Academy, I had made three TV plays in the film factory.

When I was in the first grade of middle school, the school organized an activity, and finally a film [The True Story of Teddy Boy] was shown.

I don’t know why the school showed this film. When I saw one third of it, the cinema was empty.

I took my classmate’s girlfriend and said that I must see the end, because idolize must see it.Tony Leung Chiu Wai.

I saw the end. I saw him comb his hair a few times at the end, and the film was over.

I feel very strange, because I haven’t studied this, and I don’t know why my idol has only such a little drama, but I have a feeling that this movie is quite special and different from other movies.

Because it is not as strong as a story, and there is no complete story.

It’s just that I think it’s wonderful. From then on, I began to like Wong Kar-wai’s movies, until I got to know it in this line, which can be regarded as my enlightenment.

Wangtong: For example, after "Don’t Cry at Seventeen", do you feel that its success has suddenly turned you into a person in the spotlight?

Hao Lei:No, because it was shot in 1997 and broadcast in 1998.

At that time, the information was very underdeveloped, and I was still studying in drama at that time.

I don’t feel that I have become a star at all. This play is concerned by many people, but I can’t feel it.

Wangtong: Apart from the experience of adolescence, are there any other personal experiences that have shaped you as you are now?

Because everyone says that time is a linear flow, what we have experienced before may shape us now.

Do you think there are other special and unique experiences that you can share with our audience?

Hao Lei:The unique experience is to be brave and be yourself.

Of course, we can say that life arranged for you to accept some things and meet some things, which shaped you now.

But in fact, it can be reversed. I think many things are my own choice.

For example, after I played "Don’t Cry at Seventeen", many students and high school students came to me.

Since then, I have played the role of queen, lawyer and doctor, and there will be similar roles looking for me.But I don’t wantrepeat.

Every time I choose a different one.

At that time, someone told me that people are not so familiar with you. You must first grasp a role that makes you irreplaceable.

I said that if you stay in a role, it is really single.

I think I made almost 100% choices in my acting career.

Wangtong: Alice Lowcher, the director, just told Teacher Hao Lei because she is an actress.

In fact, you can be addicted to drama, try different roles in different drama and film works, and have different lives.

For example, you are also very sure that I want to be a director.

But when you were an ignorant teenager, did you have any other dreams besides making movies or plays?

Alice Lorwacher:Yes, I have.

It should be said that I have never really had such a dream that I will become a director one day. I was dreaming all the time. What kind of dream did I have?

I hope that this dream of mine can become a part of my life. Maybe I wanted to be one at that time.beekeeper.

When I was young, I wanted to be a beekeeper, and all this was in contact with nature. At that time, I wanted to do such a job, that is, to be in contact with nature.

Being a director is actually a job choice, but I don’t think it is a job.

I think being a director is a way of life, because it allows you to observe life from different angles.

Because of this, this job actually landed on me suddenly.

From childhood, my dream was to do what I wanted to do, and at the same time, it was a life full of adventure.

So this job, it is associated with many things, as I just said.

Directing this job combines my passion in music, painting and other aspects with my work.

In particular, my dream is to tell you and describe a truth and a fact. In Italy and Europe, when we see something, such as flowers and butterflies, it is very, very beautiful.

The first thing we want to express is that it looks too beautiful to be true.

When we see something, such as flowers or butterflies, created by artists, we will say that it looks real when we think it is very good.

So in my opinion, comparing these two examples just now means that what we value most is the fact, not the truth. We should love this world, and we should be full of enthusiasm for it, especially for a truth and truth.

Wangtong: Just now you said dreams. For example, when we dream, we have good dreams and bad dreams, if we have nightmares.

We are under too much pressure in real life, so maybe our experiences in real life will be projected into dreams and good dreams.

People often say that dreams come true, because some of our desires and demands in reality have not yet been reached, and we may dream when we dream well.

So for the director, do you think if the film is a dream, is it a projection of reality or more unfinished dreams for you?

Alice Lorwacher:When we come into contact with the world in our dreams, I feel so charming at that moment, and the movie is connected with that moment.

Situations and facts in dreams can be linked together.

Wangtong: Is the movie an unfulfilled dream or a realistic projection for you, Mr. Hao Lei?

Hao Lei:It is possible. First of all, as Alice Lowcher said, we have never been able to find out exactly whether dreams are reality or reality is a dream.

Because everyone has had a dream, the dream gives you a very real feeling. Many times, you will wake up when you have a nightmare, and you will be sad for a while after you wake up.

Even when I do things during the day, I may think that I had a very sad dream last night.

I think as a filmmaker, we are actually creating an image that doesn’t exist in real life, but we must be as realistic as reality.

That’s what makes it credible.

This process, as you said, it is also possible that some things in reality are projected into my dreams and affect my dreams.

Many creative materials of movies come from life.

Wangtong: In many of your works, the role you play is actually aggressive, as if this role is against external forces.

You just said that reality and dreams are intertwined. Is it related to your own personality or experience, or do you have a special fate and a special fit for this role?

Hao Lei:It has something to do with age. When I was young, I didn’t want to choose a mediocre role. If nothing happened in a person’s life, why should I write him into a movie and become the protagonist?

Only when his life is very different will he write his story, for example, like many characters from ancient times or real people, will he write a story based on his autobiography.

An actor must choose a very different role when he is young.

Maybe at this age, my mind will change.

I think I’m trying very hard to choose some very mediocre roles, but it’s not a mediocre story. I don’t want to find a particularly strong role, because I think it’s relatively easy to play.

This choice is related to maturity.

Wangtong: Give an example.

Hao Lei: For example, some of my recent plays, especially TV plays, are relatively ordinary.

For example, the role of "Courtyard Full of Love" is really a possibility to push the door open, and your neighbor’s aunt is like this.

I think people like that are actually more difficult to play, because they need a lot of details to support them, because there is not so much resistance and subversion in life, so I think it is more interesting.

Give another example of a movie, [Spring Tide]. Although this person’s life is very depressing, his attitude is not intense. I prefer this role now.

Wangtong: Let’s talk about the director again. At present, there are three successful works.

Actually, the director’s works are full of so-called mediocre or ordinary characters, or the main characters in the film are actually like what Teacher Hao Lei just talked about.

Their experience, seemingly flat, nothing happened.

In fact, everyone’s personal feelings are almost divine, so why is the director interested in these characters?

Ordinary but not mediocre, it should be summarized like this.

Alice Lorwacher:That’s a very good question. These characters belong to some small people, very ordinary people.

No matter what kind of religious background and life background they have, there are always some sacred things in it, and at the same time, there are some children’s thoughts in their inner world, and they feel that there is such a teenager living inside.

When we make movies and choose characters, we have principles, either choose a funny person or a cunning person.

I have always looked at these characters in my movies from the perspective of children, including lazaro, who is not a child, but an adult. However, we can see that there is a child side left in his heart, that is, a very innocent side, and he is not a particularly complicated person.

I specially selected such people, through such movies, through my movies to show these characters’ special personalities.

In fact, everyone can see a main line in this character, that is to say, they are ordinary little people.

There are such people all over the world.

They live among us, ordinary but extraordinary, and have some divinity, which connects us human beings together.

Wangtong: Why are you so fascinated by the perspective of children?

Just now, the director mentioned that people like lazaro are not young and may have a pair of pure eyes. Why do you look at this complicated world from the perspective of children?

Alice Lorwacher:It should be said that in a story, there must be good people and bad people, so when describing this story, it must be from different angles, and it must be part of it.

There are some simple people and some complicated people, but it is precisely because a child can see our world from his perspective and vision that he can judge the world by himself.

It is the world that judges itself, not through our eyes or our perspective. Children’s eyes, like a ray of sunshine, can make plants grow.

I believe that if we can always use pure eyes, we can also increase our purity.

Many possibilities can be seen through children’s eyes, because after a certain life experience, our eyes actually have their own filters.

And through children’s eyes, we can see the world for the first time, rediscover the difference of this world and rediscover a new world without any filter.

Hao Lei:I think it’s really important to be an artist.

There is no way to be so rational, and there is no way to be particularly sleek and sophisticated.

I think it’s interesting for the director to choose such a character. Maybe this is also a way for her to observe the world.

Wangtong: Do you usually have any so-called methodology in interpreting roles?

Hao Lei:In fact, the method is very complicated, because for me, performance is actually a comprehensive subject, and it also needs many scientific methods to shape a role.

But I think the most basic thing is truth and sincerity. If you can’t fully understand yourself and see your true nature, there is actually no way to play a role wholeheartedly.

Wangtong: Different art forms, such as the recent spring tide, are realism.

Colleagues are curious. For example, in early dramas, surreal passages are interspersed. What is your mood when you interpret different roles?

Hao Lei: It’s a bit biased.BrechtDrama education in our country is based onStaniMainly.

If explained in the simplest way, the expression of modern dance and artistic form often externalizes my inner activities and glows through some performance methods.

Some viewers may not be used to watching this way, and they will find it difficult to accept breaking the tradition.

But many viewers think it’s quite new. I want to see something new.

But in fact, in foreign countries, various methods have already existed.

Wangtong: As far as you are concerned, it always seems that there is such a binary opposition between the movie and the business.

For example, I summed up the binary opposition, such as objectivity and subjectivity, rationality and sensibility, realism and romanticism.

As an actor and a creator, for example, how do you balance the so-called binary opposition elements when interpreting this work?

Hao Lei:We can only make a balance in our own thoughts, because our world is full of binary opposites, such as day and night.

It is a question of personal understanding and personal cultivation. If we can’t really confirm the existence of binary opposition first, we can’t break the binary.

But many times people are confused and say that we should not be so absolute or so black and white, but I always say one thing:

If I can’t distinguish between black and white in my life, how can you see the advanced level of gray again?

So many things I think are really different for everyone to understand.

There is also an example just now. On the issue of commercial films and art films in our industry, everyone has an inertia thinking that art films look better and commercial films are more rotten.

Actually, it’s not like this at all. There are many bad art films, good-looking commercial films and many good-quality ones.

So for me, it doesn’t matter whether you are a good-looking movie or an excellent movie, which so-called label.

Wangtong: Are your recent attempts both?

For example, in recent days, what do you think will attract your works or projects?

Can they sum up the rules, or have some commonalities?

Hao Lei:Not particularly regular, because my thoughts are always changing.

It is what I want to express at every stage, and my understanding of this world is constantly changing.

Can I happen to have a work with the same expression as mine come to me? Not necessarily.

But many times I think it’s ok. From all aspects, it may be a more professional team, and maybe I will choose him.

Maybe everyone thinks it’s better. For example, works like "Spring Tide" just fit in with my current desire to express my attitude and understanding of the world.

Wangtong: I also want to ask the director this question. I saw the director’s interview before, and it was also said that there are actually three films, and the financing situation of this one is quite hard.

Whether in China, Italy or Europe, it is quite hard to make a literary film.

So can the director tell us something, such as what you experienced when you introduced your film project to others?

Alice Lorwacher:My experience should be said to be difficult but also very beautiful.

It should be said that it was a positive difficulty. I remember one very important thing.

When I asked[miracle]The producer of this film introduced my first film. I didn’t have much confidence at that time, because I had never studied before and I didn’t know much about the movie world.

It should be said that I entered this world, but actually I don’t know some rules of this movie world.

When I talked to him, I said I didn’t know if anyone would like this film.

Then the producer said to me, who do you think you are? I said, what? Do you think you are so special? Is it special? Can your film be enjoyed by all people? You’re not the only one.

Your film may not please everyone, but you may only please some of them.

So there must be a group of such audiences who will like your film, and some will not.

Please remember that you are not the only director in this world. Many people in this world, like you, hope to get this audience.

This principle can be said to have dominated my choice of making this film.

When I make a choice, I don’t mean that it must be what I like.But it must be a film that I want you to see, and it can bring you different experiences, and at the same time, I want to experience this experience with my partners.

Of course, we always have to abide by a certain budget when making films. We are not the kind of films with big investment.

We can at least achieve the level and content we want to do within the limited budget.

We have cooperated with producers of different organizations and structures.

For me, I think what I like more is not to discover, but to be able to tell you a true story. Both are very important to me.

Wangtong: Will it be easier for your work to win prizes at major film festivals?

Alice Lorwacher:Of course, the film was well received, and it will be much easier for me to find a new producer after winning the prize.

I never said how much production cost I was going to find.

I always don’t like things that are particularly easy to do. I always think that you have a little difficulty in doing things, which will increase your strength.

It is a very important point for individuals to grow up.

So I want to say that so far, we have been having difficulties.

It is precisely because we face these difficulties and solve them that we will become stronger and stronger.

Every time we encounter difficulties, it can be said that the difficulties are greater than the previous ones.

Especially at this time, a year has passed, and our cinema has not been opened, and it was never related during the World War.

Italian cinemas have never been closed since there were movies. This year has been closed for one year, which is a very, very difficult time for us.

I have always thought that movies should be a part of our lives.

I always hope to combine many life experiences. I hope to be an artist, and then this artist can gather all the people in one room through one of my artistic creations, instead of isolating them from each other.

I want everyone involved in this movie to feel the true meaning of life.

Now the film is in a very difficult period, and we should also consider that people may be in a state of separation.

For example, I’m thinking about a movie like Happy lazaro, which leaves many problems.

It’s not just the movie, but the audience who watched the movie. When they leave the cinema, they can take this question as gossip material and bring it into your life.

This can be used as a topic of conversation. Now, in this isolation period, everyone lives in his own small circle.

At this time, we may pay more attention to what kind of film we want to make, and may consider more than the dark side of life.

Wangtong: This year is a special year, with ups and downs from the beginning of the year to the recent epidemic.

This special year has also changed one of our lifestyles, including social habits, because everyone wants to keep such a social distance.

The director actually keeps a positive and optimistic attitude.

For you, because some people will get more inspiration from generate because of such a condition and such a restriction, what have you tried this year, Mr. Hao Lei?

Hao Lei:For me, I think it may still be a good thing.

Because we have to go out all the year round in this kind of work, we can’t go anywhere now, so we just stay at home.

I feel that I haven’t stayed at home with my family for so long for several years. This is another life.

It’s okay. I don’t think there’s anything wrong.

And finally you can calm down. In fact, many things are not for you, but for you.

So if you have to be quiet because of this epidemic, in fact, I think it is also a good thing.

Wangtong: If you were in the film industry, what other career would you choose or what other things would you like to do?

Hao Lei:I haven’t thought about it. Maybe I will be a director, and maybe I will work behind the scenes.

Wangtong: Just now, you said that you have played different roles in various projects before. What kind of roles will make you feel particularly exciting and interesting? You can try more.

Hao Lei:Nothing is more special, it’s all the choice of the moment.

It is also possible that I feel fine at this moment, and I feel very energetic at that moment, and there is nothing special to treat a certain play or a certain role.

Is that your choice is the most important.

Wangtong: Let me ask the director. Just now you said that if you don’t become a director, you might become a beekeeper.

Did you mention your next work? Do you have a more specific description of this next work?

Can you disclose it?

Alice Lorwacher:I have a movie now. I haven’t filmed it yet, but it depends on the development direction of the epidemic.

My thoughts and ideas are clear now, and I am writing this script.

This script is difficult to speak now, because it is still an unfinished script.

It is a story about human civilization in the past, and the collision between past civilization and modern civilization is reflected through archaeology. It should be said that this is a film involving many aspects.

I want to take the middle line in this movie, not particularly relaxed, but also not particularly serious.

It is a story that seems to make people feel more interesting. But I will talk about a more serious topic.

I have a lot of work to do at the same time, and now I am watching the epidemic trend, and then I will decide when I can start shooting this film.

Wangtong: If you can travel through time and space, what would you like to say to yourself who has just stepped into the film and television circle?

Hao Lei:Just a little girl, you will be very powerful in the future.

Wangtong: What about the director? If I could travel through time and space, what kind of words would I like to say to my original self?

Alice Lorwacher:What to say? Keep dreaming, but be down to earth.

CCTV Foreign Language New Media Reporter: Hello, Teacher Hao Lei. Many forums and master classes in the film festival have paid attention to women’s power.

You mentioned before that you want to speak more for women. Why do you think so? What do you want to do next?

Hao Lei:I think women’s power is really easy to be ignored or even ignored.

I didn’t advocate emphasizing any kind of power.

But when this kind of situation really exists in this world and this society, I think it is necessary to speak out.

But as for what to do specifically, I think it is difficult for us to do things other than movies.We will help women more.subject matterFilm, female film workerThis is what I can do.

Question: I am also a reporter from CCTV.

I know that you recently wrote a book about performance. What do you want to express through this book?

I also want to ask you a question. You have been studying Buddhism for a long time. How do you think this experience has affected your artistic creation? Thank you.

Hao Lei:Let me answer the first question first. The basic content of this book comes from the complete works of stanislavski, which means that I read this book for everyone. This is the granddaddy of the performance.

But today young people don’t like reading. Many people say how to learn acting or where to learn acting.

It’s very simple. Actually, reading is good, because people don’t like reading, so I use my language, a more refined and easy-to-understand language to help you read this book.

This book will share a lot of my experience as an actor for more than 20 years.

The second question: Buddhism has given me a broad vision and a tolerant attitude. I often think about roles one-sidedly, but I think Buddhism has given me a high view of people in life and the roles I play. Thank you.

Question: I like your [Happy lazaro] directed by Alice Lowcher very much. I think it is a very realistic story about human nature, and you express it in a magical way.

How do you guide the actors when shooting such a story?

Do you want actors to believe this story more, or do you want them to be immersed in a more uncertain state?

Alice Lorwacher:Thank you for your question. When filming this [Happy lazaro], this script was the first difficulty, not the difficulty in the script.

At first, after reading this play, everyone thought that the role of lazaro was a fool.

At that time, I tried to tell the actors this story. I said that lazaro was not a fool, and lazaro would learn. He was not a fool.

When telling stories to Adriano Tardiolo, I found that he knew lazaro very well, and he understood it in a dreamy way.

I made this film, and I think the biggest challenge is to find a very good actor like Adiano.

He really added a lot of value to our play. So Adriano and I co-produced this film, and it really felt like a wonderful experience.

We all felt the dreamy language of this film during the filming.

It can’t be said that everyone became stupid after making a movie. It should be said that after making this movie, everyone didn’t think of such a character, a surreal character. In fact, we can see the shadow of such a character in real life.

After his first death, many years later, the world changed, changed, and he watched the world change again.

So during my cooperation with Adriano, a very excellent actor, we further sublimated this character.

Question: Hello, Mr. Hao Lei, I’m a director from Guangdong, a little director.

Would you like to ask if you will continue to play in the drama in the future?

Because I have a group of friends who like watching drama very much, and I am very much looking forward to your continued performance of Rhinoceros in Love. I want to ask you.

Hao Lei:There is a drama, as it was last year, but there is no drama this year because of the epidemic. If there is no epidemic, I will play a drama every year.

I don’t want Rhino. I don’t believe in playing a little girl who is persistent in love at my age.

Question: Hello, Sister Hao Lei. I am an actress myself. My enlightenment began with your Rhino in Love. I like your play very much.

As an actor, I have a puzzle. Now most movies are shot at a high-intensity and fast pace.

Probably not like in our school, we have a long time to rehearse, make our own biographies, study characters, observe life and practice for a long time.

I think this is a creative process that is relatively in line with the rules of actors’ creation.

I especially want to ask Mr. Hao Lei here, if you encounter such a situation, how to solve it.

Because we often get the script, maybe it’s really three days in advance, and I just got the book, so I simply played around reading.

If I am not satisfied with my understanding of the role, I will devote myself to creation.

I am not satisfied with this creative process, but there is no way. I can only solve this problem from the actors themselves, and I especially want to ask the teacher.

Hao Lei:There is an old saying in the actor business that I believe you have heard.One minute on stage and ten years off stage.It is necessary to accumulate more training in peacetime.

As for how to deal with practical problems, I think so and do so.

If you don’t want the world to change you, the world can’t change anyone. Come on.

Question: Alice Lowcher recently filmed the drama My Genius Girlfriend, and China was also very popular.

I would like to ask if the shooting technique and narrative method of this TV series are different from those of the previous three feature films. Thank you.

Alice Lorwacher:Thank you very much for this question. The technique is definitely different.

First of all, it is technically different, because I have been shooting with film before.

The previous technology is very old, a traditional shooting technology, and it is also a kind of technology that I love very much.

Because in this case, you can fully control, all aspects can be under your control, and the shooting process will make you fall in love with this job.

You can also guarantee that the final result will completely reach the result you want.

In the process of shooting, there will be a certain gap between the material you shot and the final result.

When you try to make movies, I suggest that you should try traditional techniques.

In the process of shooting, the pressure it brings to you brings me a lot of strength and makes me have great enthusiasm for my work.

The use of digital technology this time, from a certain point of view, is very charming.

On the other hand, it is different from the way I am used to.

In this process, we should respect the materials you want to use, and at the same time, we should invent and create some different ways to use these pictures.

At the same time, I should respect the story of the characters I want to describe. This is the first time for me to use this technology to describe other people’s stories.

So I worked in a completely different way, different from when I made three feature films, because when I made such a feature film, I was not very sure about my final result.

There will be some changes among us, and new things are constantly discovered during this shooting process.

Using digital technology is very clear about what to do and what kind of results will be obtained.

Although the methods are different, both methods are very popular.

The most important thing is how to describe the stories we like and love in the right way.

Question: I would like to ask Mr. Hao Lei that for actors, we also know that Mr. Hao Lei is the queen of literary films, which are closer to the heart, but commercial films may be closer to the audience.

I want to know what teacher Hao Lei thinks of this balance, or from the Buddhist point of view, what is this choice?

Hao Lei:As the director said before, you should know from the beginning whether you choose more audiences or fewer audiences.

When I was very young, I was told that you should think it over, because if you play a film with a small audience, you may not have the so-called red, so-called star status.

But for me, I don’t think it’s important. I have to follow my own heart. I think this is the most important thing.

No big star, like Madonna, can make people all over the world like you. I have long known that that is not what I pursue.

I have to choose what I like, and I would be honored if some viewers are of the same kind as me.

If not, I don’t want to force it. This is my understanding. Thank you.

Question: Alice Lowcher, I like your work Happy lazaro in 2018 very much, and I like a scene in which the hymn in the church leaves with lazaro.

My feeling is more like the redemption of a character like lazaro from a more divine and higher power.

What I want to ask is why you are so interested in such a theme of possible higher and more divine redemption, whether it is power or not, in some works now or before.What about shooting such a theme, a brand-new salvation force? Thank you.

Alice Lorwacher:Thank you very much for asking this question.

Each of us has a limited life, and we have to answer many questions and different types of questions in our life.

Essential problems are some problems that we human beings face together.

I want to answer these questions through the character lazaro, who was in a dilemma and dying.

He faced many problems at that time, not to say that he died immediately. He also encountered many such problems before. For example, when he went to the bank, he had to borrow money.

Before I made this film, I thought it would be too painful for lazaro to be too lonely and dying at that time, if he was particularly lonely.

So at this time, I think we should add some music.

To convey such a message, lazaro is now facing such a dilemma.

At this time, music, music from the church, music of redemption, gave him a kind of spiritual support and pillar when he was in the most difficult time.

This scene of redemption, it is actually at this time that such music came, which is very appropriate, but it is not common.

When he entered the bank, there was such a redemption.

This mainly means that lazaro is never alone.

I interpret some uncertain factors in life through this sacred way of redemption.

Wangtong: OK. Thank you, director. Thank you, Mr. Hao Lei.

As a conclusion, our theme just now was the interpretation of dreams, including teacher Hao Lei’s saying that there is no absolute black and white, and the director also said that there are no absolute good guys and bad guys.

Before, when we were faced with the ever-changing technology, we always felt that it hindered people from getting closer.

But thanks to technology, friends from different regions can gather together in such a special year.

Listen to two guests sharing their lives with us, including their creative experiences.

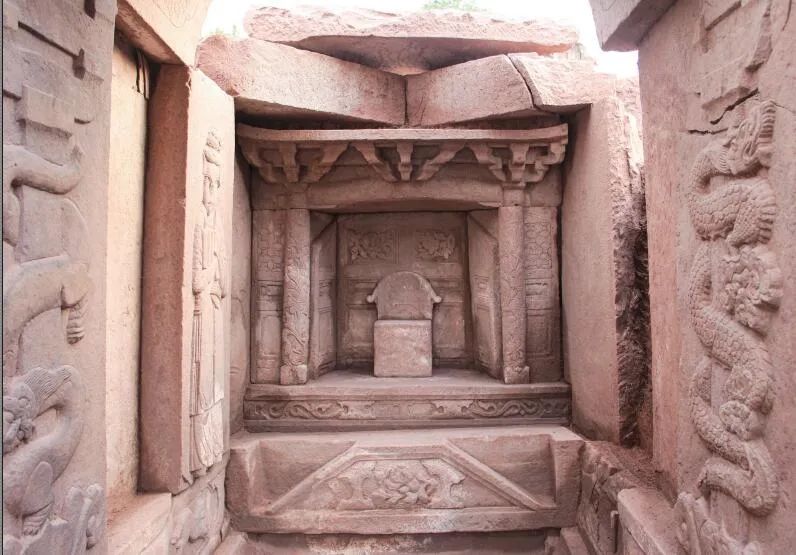

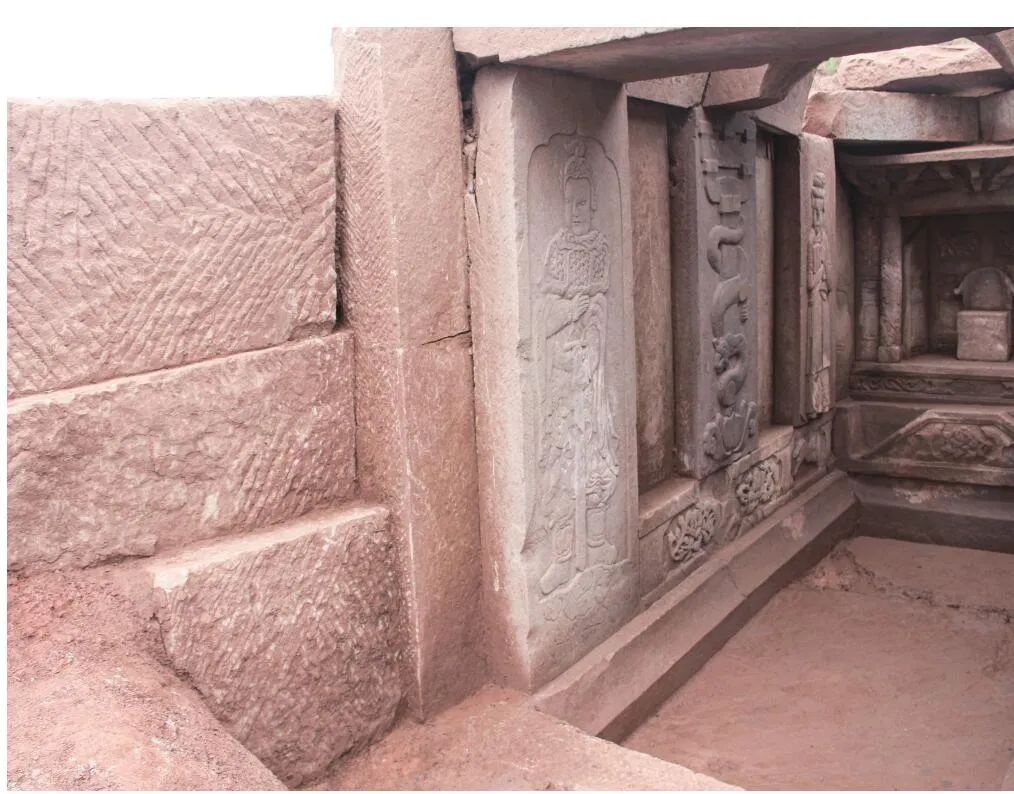

Local geographical environment of Foyan Temple tombs in Yongchuan

Local geographical environment of Foyan Temple tombs in Yongchuan Sculpture of Song Tomb in Jiangjin Baisha Middle School

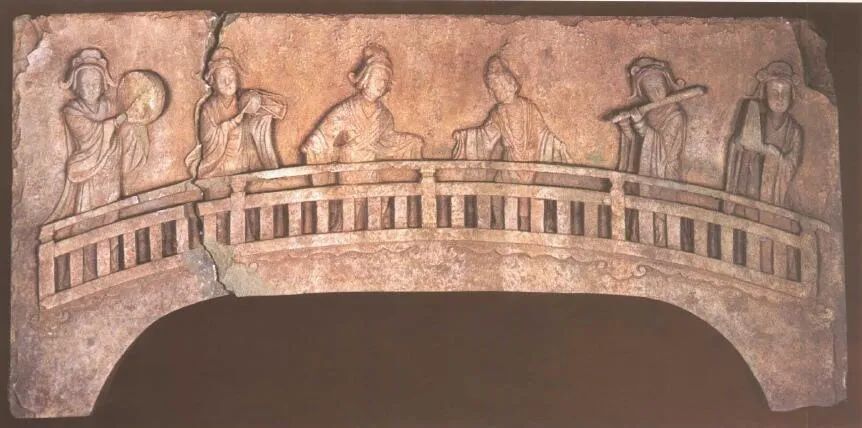

Sculpture of Song Tomb in Jiangjin Baisha Middle School Music and Dance Stone Carvings in Song Tombs in Luxian County

Music and Dance Stone Carvings in Song Tombs in Luxian County Dance Stone Carvings in Song Tombs of Luxian County

Dance Stone Carvings in Song Tombs of Luxian County Nanchuan came to visit the coffin of the Song tomb.

Nanchuan came to visit the coffin of the Song tomb. "Penglai map" on the back wall of the couple’s tomb written by Yu Gong in the Southern Song Dynasty

"Penglai map" on the back wall of the couple’s tomb written by Yu Gong in the Southern Song Dynasty Decoration at the Back of Hejiawan Tombs in Hechuan

Decoration at the Back of Hejiawan Tombs in Hechuan Side wall decoration of song tombs in Hejiawan tombs in Hechuan

Side wall decoration of song tombs in Hejiawan tombs in Hechuan Burial objects in the back niche of the Song Tomb of Jiangjiazui Tomb Group in Shapingba

Burial objects in the back niche of the Song Tomb of Jiangjiazui Tomb Group in Shapingba The beast head and personal warrior in the Song tomb of Guantian in Zheng ‘an, Guizhou

The beast head and personal warrior in the Song tomb of Guantian in Zheng ‘an, Guizhou Map of Eight Diagrams and Phoenix Birds in Song Tomb of Sanxizi in Jiangjin

Map of Eight Diagrams and Phoenix Birds in Song Tomb of Sanxizi in Jiangjin