"Our comprehensive performance did not meet expectations." At the beginning of 2024, Li Bin, founder, chairperson and CEO of NIO, bluntly stated in the internal letter at the beginning of the year. On the evening of March 5, NIO released the fourth quarter and full year financial results of 2023. In 2023, NIO achieved revenue of 55.618 billion yuan, gross profit margin fell by 4.9 percentage points year-on-year, and net loss further expanded by 43.5% to 20.72 billion yuan.

In 2023, NIO delivered 160,000 vehicles, ranking second among new forces, but compared with the results of "sales crown" Li Auto 376,000 vehicles, there is a gap of 216,000 vehicles, and there is a great fault. At the moment of intense price war, can the listing of the new brand "Alps" series this year reverse the current delivery status of NIO?

Losses further widened

The financial report shows that in the fourth quarter of 2023, NIO achieved revenue of 17.103 billion yuan, an increase of 6.5% year-on-year, down 10.3% from the third quarter of 2023; the net loss was 5.368 billion yuan, and the year-on-year loss narrowed, expanding by 17.8%. At the same time, the gross profit margin in the fourth quarter of 2023 was 7.5%, an increase of 3.6 percentage points year-on-year, and a decrease of 0.5 percentage points month-on-month. During the same period, the gross profit margin of automobiles was 11.9%, both year-on-year and month-on-month.

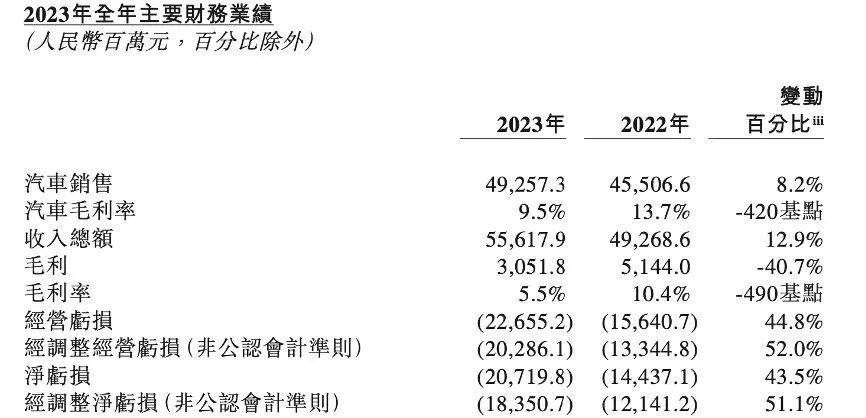

In 2023, NIO achieved revenue of 55.618 billion yuan, an increase of 12.9% year-on-year; net loss of 20.72 billion yuan, an increase of 43.5% year-on-year, and a loss of 14.437 billion yuan in the same period of 2022.The cumulative loss in the first three quarters of 2023 alone has reached 15.352 billion yuan, exceeding 2022.

In 2023, NIO’s overall gross margin and automotive gross margin both declined, with a gross margin of 5.5%, down 4.9 percentage points year-on-year; automotive gross margin was 9.5%, down 4.2 percentage points year-on-year.

It is worth noting that since 2021, NIO’s gross margin and vehicle gross margin have gradually declined, with gross margins from 2021 to 2023 being 18.9%, 10.4%, and 5.5% respectively. However, NIO’s vehicle gross margin has increased quarter by quarter in the four quarters of 2023, from 5.1% in Quarter 1 to 11.9% in the fourth quarter.

According to industry analysts,The main reason for NIO’s further widening losses in 2023 is its continued spending on research and development and infrastructure.In 2023, NIO’s R & D expenses will be 13.43 billion yuan, an increase of 23.9% year-on-year.

In terms of supplementary energy infrastructure buildings, in 2023, NIO will build 1,035 new substation stations around the world, with a total of 2,350 completed. Continued R & D investment and the expansion of substation infrastructure and user centers have increased NIO’s financial pressure.By the end of 2023, NIO’s cash reserves amount to 57.30 billion yuan…

For the mass market

The new brand "Alps" will be launched in the second half of the year

After delivering 245,000 vehicles in 2023,In 2024, NIO has set a delivery target of 230,000 vehicles for the whole year.NIO expects to deliver 31,000 – 33,000 vehicles in the first quarter of this year, a decrease of 0.1% from the same period in 2023 to an increase of 6.3%. From January to February this year, 10,055 vehicles and 8,132 vehicles were delivered respectively. On March 5, Li Bin said at the performance meeting that he is confident to return to the level of monthly delivery of 20,000 vehicles.

Reporters learned that NIO will launch a new brand "Alps" in the second half of this year, priced 200,000 yuan – 250,000 yuan, for the public brand, to fill the current brand price gap. At present, NIO has released 9 models with a price band of 300,000 yuan – 800,000 yuan. Among them, the NIO intelligent electric executive flagship ET9 with a pre-sale price of 800,000 yuan will be delivered in the first quarter of 2025.

Li Bin said that there will be more than 100,000 yuan of models on the market in the future. At the moment of intense price war, the listing of the "Alps" series can reverse the current delivery status of NIO, and it remains to be seen whether the top three in the new energy market of more than 200,000 yuan this year.

"We judge that in the new energy vehicle market of more than 200,000 yuan, by the end of this year, there will be a particularly clear top three, and they will even occupy 70% of the market share. Among the top three, we (Li Auto) and Q Jie will definitely be in it." Liu Jie, vice-president of business at Li Auto, said in an interview with reporters on March 1.

(Article source: China Securities Journal)

关于作者