As soon as the good shop changed coaches and reduced prices, it threw another deep-water bomb into the market.

On December 6th, Lanmedia Exchange learned from the good shop that Ningbo Guangyuan Juyi Investment Co., Ltd. (hereinafter referred to as "Guangyuan Juyi"), a wholly-owned subsidiary of the company, formally filed a lawsuit with the people’s court on November 27th because the invested company Yichun Zhao Yiming Food Technology Co., Ltd. (hereinafter referred to as "Zhao Yiming") deliberately concealed the company’s major events and damaged the minority shareholders’ right to know during the cooperation period between the two parties. At present, the court has accepted the case.

This major event refers to,Zhao Yiming and Snacks were very busy and merged on November 10th.

According to Tianyancha, Zhao Yiming Snacks was founded in 2019. In February, 2023, Zhao Yiming completed the 150 million A round of financing, with Black Ant Capital leading the investment and good shops following the investment. The valuation is around 1.5 billion. After the completion of financing, Zhao Yiming snacks expanded rapidly.

On October 17th this year, Liangpin Store announced that 3% equity of Guangyuan Juyi Clearance Zhao Yiming was transferred at a total price of about 105 million yuan.

Just 22 days after the transfer of equity in Liangpin Store, Zhao Yiming, the third snack seller, and Busy Snacks, the oldest snack seller, completed the merger.

Liangpin Store believes that in such a short period of time, two companies with such a large volume have actually completed all the processes required for the merger, such as due diligence, negotiation, contract drafting and investor approval, which obviously does not conform to the normal investment process. "

Based on this, a complaint filed by Liangpin Store brought Zhao Yiming to court.

As of press time, "Zhao Yiming" did not reply to this matter. "Snacks are very busy," the relevant person said: "We don’t reply to this matter."

01 combing the timeline, there are many doubts

According to public information, Blue Media has sorted out the timeline of the breakup and merger of the three companies:

On April 11th, 2023, "Guangyuan Juyi" invested RMB 45 million, accounting for 3% of the shares, and became a shareholder of "Zhao Yiming";

On September 28th, 2023, Zhao Yiming executives Zhao Ding and Wang Pingan, one of the shareholding platforms for holding "Snacks Busy", Yichun Yikou Bird Management Partnership (Limited Partnership) completed the registration in Yuanzhou District, Yichun City, and the executive partner of the enterprise appointed Zhao Ding, the founder of Zhao Yiming.

On October 16, 2023, "Guangyuan Juyi" transferred its 3% equity of "Zhao Yiming" at a price of 105 million yuan, clearing the "Zhao Yiming";

On October 19, 2023, "Guangyuan Juyi" received all equity transfer funds;

On November 10th, 2023, "Zhao Yiming" and "Snacks Busy" released a merger statement. According to the national enterprise information credit publicity system, both parties have completed the industrial and commercial change registration on the day of announcement. "Snacks Busy" became the shareholder of "Zhao Yiming", accounting for 87.76% of the shares.

According to the time line, Liangpin Store thinks: "It is impossible for two leading enterprises in the snack industry, which involve nearly 7,000 stores and have a valuation of about 9 billion, to complete all the processes required for the merger in just’ 22 days’."

Liangpin Shop pointed out that during the shareholding period of Guangyuan Juyi, Zhao Yiming never consulted the shareholder Guangyuan Juyi on the merger with Snacks Busy. Liangpin Shop also stressed that judging from the clues such as the establishment time of the shareholding platform, the initiation and decision of the merger between the two parties occurred before Guangyuan Juyi sold its shares in Zhao Yiming.

"In business operations, the merger between companies may involve a lot of work, including but not limited to due diligence, negotiation, contract drafting, investor approval, etc., which usually takes months or even years.Generally speaking, the merger is completed in 22 days, which is rare in practice.Lawyer Wang Weiwei, a partner of Zhongwen Law Firm, said to Blue Media Exchange: "Whether the two parties completed the merger procedure within 22 days, it also needs further evidence from both parties in the litigation process to support it."

When explaining the starting point of Liangpin Store’s transfer of the equity of "Zhao Yiming", Liangpin Store said that it was Zhao Yiming and related parties who stressed from beginning to end that the company planned to go public independently and hoped that Guangyuan Juyi would take the initiative to transfer the equity.

As for the losses, Liangpin Store believes that Zhao Yiming’s deliberate concealment and guidance directly led to Guangyuan Juyi transferring its equity based on the wrong or untrue trading background and pricing basis, which seriously damaged the legal rights of Guangyuan Juyi.

A person close to Liangpin Store said: "The Company Law clearly stipulates that Liangpin Store, as a shareholder of Zhao Yiming, has the right to know the important resolutions of Zhao Yiming, and it also has the legal rights of knowing, making decisions, checking and preempting in such a major asset reorganization.If Zhao Yiming informs Liangpin Store of its busy merger plan with snacks, Liangpin Store will probably exercise its preemptive right instead of clearing the warehouse."

According to Liangpin Store, before suing Zhao Yiming, Guangyuan Juyi sent an official letter to Zhao Yiming Company on November 21, 2023, requesting relevant documents on financial and major issues during the shareholding period from April 11, 2023 to October 16, 2023. However, "Zhao Yiming" Company has not yet replied to "Guangyuan Juyi" and provided relevant documents.

02 good shop,Turn "passive" into "active"

In fact, from the outside world, "snacks are very busy" is the number one enemy of good shops.

Up to now, the number of busy snacks stores has exceeded 4,000, and it has become a competitor with good shops on the route of "countryside surrounding cities". The number of stores in Zhao Yiming was 2,500. After the merger of the two brands, there are 6,500 stores after the integration, which is much higher than the 3,344 stores in the offline channel of the good shop.

"So, this merger information is very important for the good shop to transfer the equity of Zhao Yiming. If the lawsuit of the good shop is established, Zhao Yiming’s behavior not only infringes on the right to know of minority shareholders, but also does not conform to business ethics. " Analysis of Lawyer coach benny from Zhejiang Tiequan Law Firm to Blue Media Exchange.

But the reality is that Zhao Yiming has merged with Snacks Busy. Then, the "deliberate concealment" of Zhao Yiming by good shops,Prosecution is a "must-do" and a measure to reverse the "passive situation" to the "active situation".

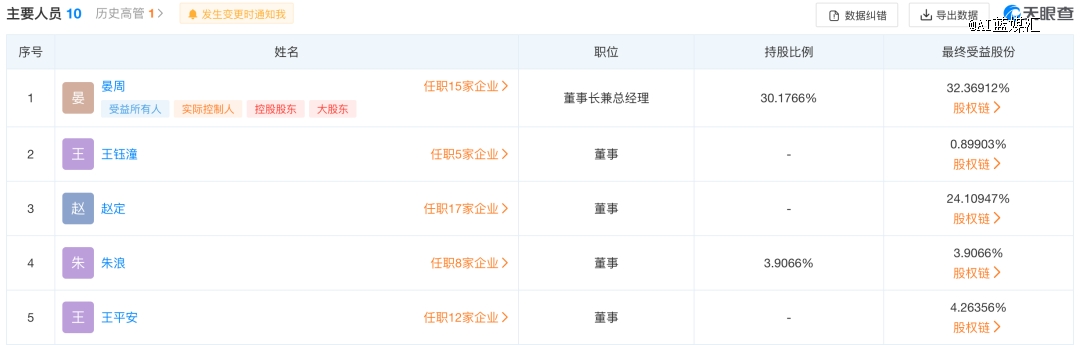

As early as when Zhao Yiming and Snacks were busy completing the merger, the insiders analyzed that Zhao Yiming and Snacks were busy merging to prepare for listing. From the perspective of the merged shareholding structure, Snacks Busy holds 87.76% of the shares in Zhao Yiming, while Zhao Ding, the founder of Zhao Yiming, holds 32% of the shares of Snacks Busy through Yichun Bird Nest Advertising Information Culture Communication Co., Ltd. and Yichun Bird Management Partnership (Limited Partnership), becoming the second largest shareholder of Snacks Busy.

And a complaint from a good shop,Undoubtedly, the honesty, contractual spirit and even legal consciousness of Zhao Ding, the second key figure who is busy with snacks, have been openly questioned and denied.

It is worth mentioning that, on November 10th, China Securities Regulatory Commission just released the latest opinion draft explanation on the regulation of IPO guidance for A-shares, which clearly stated: "In order to promote the establishment of honesty, self-discipline and legal awareness of the actual controllers and directors of the company, and improve the quality of listed companies from the source, the reputation of the actual controllers, directors, supervisors and senior managers of the company to be listed will become the focus of IPO audit".

That is to say, under the influence of Zhao Yiming’s reputation crisis, the busy listing of snacks will be difficult.

In addition, the snacks are busy and the stores in Zhao Yiming are "joining mode".Under the lawsuit, potential franchisees will also rethink the brand.

Since the beginning of this year, the "low price" dispute has ignited the booster for the brand of discount snack track. But in fact, discount snacks only bring consumers a "low price" mentality, not a real "low price".

This argument has also been proved by people in the industry and consumers: "The business logic of discount snacks is to" beat "the price by subsidizing some standard products in the store, implant the" low price "mentality into users, and then obtain the final profit by selling white-brand products."

"The price comparison channels of consumers of white-brand products are rather vague. And for food safety, consumers are also worried. " On the third-party social platform, many consumers said that if the weighing price of products with busy snacks is converted into a unit price, it is not cheap compared with the e-commerce platform, and the cost performance is average.

In fact, in the current market environment,Consumers pay attention not only to cheap, but also to quality. When consumption tends to be rational, consumers are more concerned about the "quality-price ratio".

Previously, good shops stepped out of the move of "reducing prices without degrading quality", which also turned passivity into initiative, taking the initiative of "cheap on the premise of quality" as the son, and will sell snacks in bulk.

Consumers and the capital market all vote with their feet, which also proves that under the "quality-price ratio" equilibrium, the return of snacks to the parity era is the only solution.

关于作者