Affected by the lack of core and rising raw material prices, the performance of listed car companies is under pressure.

Author | Zhen Yao

Edit | Jane

Produced by | Bangning Studio (gbngzs)

2021 has entered the countdown, with only the last two months left. After entering November, it seems that overnight, autumn and winter have completed the seasonal change, and the temperature in many parts of the country has dropped precipitously.

This sudden chill is also reflected in the third quarter financial report of most mainstream listed car companies.

As of the close of November 1, SAIC, Great Wall Motor, BYD, Guangzhou Automobile Group and many other A-share listed car companies announced their third quarter 2021 financial reports. Bangning Studio counted the data of 10 car companies and found that only Changan Automobile rode the dust and achieved net profit growth.

Compared with the sharp recovery in the first and second quarters, listed car companies once again encountered profit pressure in the third quarter. Most car companies’ revenues and profits have both declined, and the decline rate is basically above double digits, even exceeding 200%.

In terms of net profit alone, in the third quarter, among the 10 car companies, except Changan Automobile, 9 all experienced different degrees of decline. Although Xiaokang, Beiqi Blue Valley and Haima did not disclose the year-on-year data of net profit in the financial report, their net profit in the third quarter was negative. Obviously, their business development is facing no small challenge.

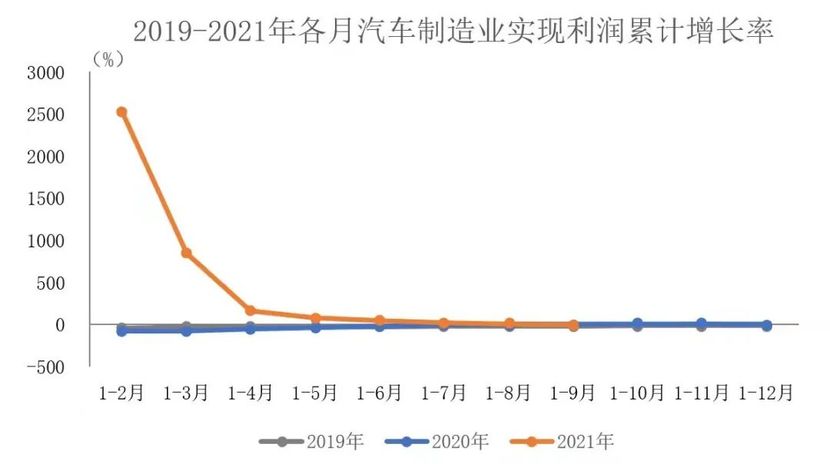

On October 29th, the latest data from the National Bureau of Statistics compiled by China Association of Automobile Manufacturers showed that the profit of the automobile manufacturing industry increased by less than 2% in the first three quarters of this year. In the first three quarters, the accumulated profit of the automobile manufacturing industry was 379.97 billion yuan, up by 1.2% year-on-year, and the growth rate dropped by 4.3 percentage points from January to August, which was lower than that of enterprises above designated size by 43.5 percentage points.

The China Automobile Association said that the impact of chip shortage is still going on, and it is expected that profits may show negative growth after October.

▲ Image source: China Automobile Association

Under the impact of unfavorable factors such as lack of core and rising raw material prices, many car companies need to bear the pressure of performance to move on in the short term; In the long run, we should also deal with the changes of the new four modernizations and globalization in order to develop with the trend.

▍ Full pressure bearing

Since the end of 2020, the chip shortage storm has become the core issue that affects the recovery of the global automobile industry and the stability of the supply chain after the outbreak of the epidemic. In the third quarter of this year, in addition to the shortage of chips, the automobile industry in China is also facing soaring prices of raw materials, non-ferrous metals and electronic components, which has hindered the rapid recovery of most automobile enterprises in the "post-epidemic era".

According to the data of China Automobile Association, in September, the production and sales of passenger cars were 1.767 million and 1.751 million, respectively, down by 13.9% and 16.5% year-on-year, and the decline was 2 and 4.8 percentage points higher than that in August. From January to September, the production and sales of passenger cars were 14.658 million and 14.862 million, respectively, up by 10.7% and 11.0% year-on-year, and the growth rate continued to drop by 4.5 and 5 percentage points from January to August, and the cumulative growth rate continued to drop sharply. "The shortage of chips has affected production and sales to some extent." According to the analysis of China Automobile Association.

▲ Image source: China Automobile Association

The decline in performance is more intuitive in the third quarter financial reports of major car companies. Bangning Studio believes that it is mainly manifested in two points:

First, SAIC and GAC, which take joint venture brands as their profit pillars, both lost to joint venture brands, and their net profit in the third quarter fell by more than double digits. Second, 40% of the car companies represented by Great Wall Motor and BYD, due to the shortage of chips and the rising price of raw materials, increased revenue does not increase profits.

Take SAIC as an example. As a leading automobile enterprise in China, its revenue and net profit both declined in the third quarter.

For a long time, the joint venture brand has been regarded as a "cash cow" by car companies. SAIC, which holds SAIC-Volkswagen, SAIC-GM and SAIC-GM-Wuling, is one of the representatives. Over the years, it has made a lot of money by virtue of joint venture brands. However, in the third quarter of this year, the operating income of SAIC decreased by 13.5% and the net profit decreased by 14.75%.

▲ Image source: SAIC Group Production and Marketing Express

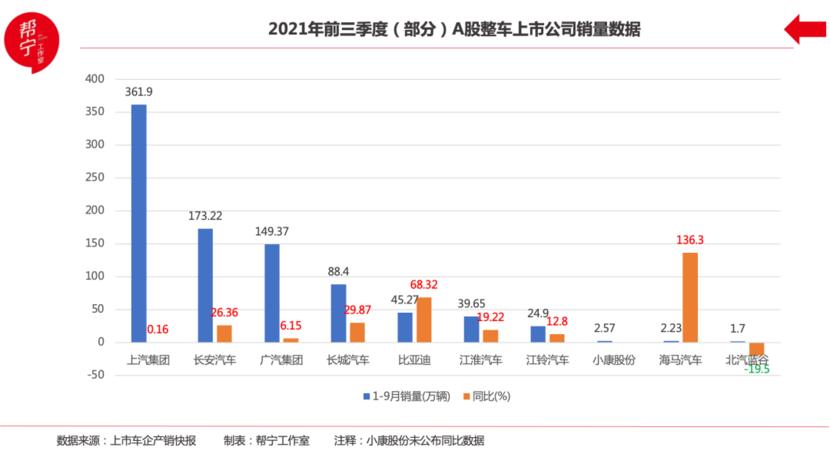

Saic’s revenue profit has shrunk this time, which is related to sales performance. The data shows that its cumulative sales volume in the first three quarters was 3.619 million units, a slight increase of 0.16% year-on-year. According to previous data, SAIC sold 2.297 million vehicles in the first half of the year, up 12.1% year-on-year.

SAIC Volkswagen and SAIC-GM are "profit cows" of SAIC. Under the influence of lack of core, the sales of the two companies are greatly reduced. The data shows that in the first three quarters, the cumulative sales volume of SAIC Volkswagen was 850,400 units, down 17.54% year-on-year; The cumulative sales volume of SAIC-GM was 901,900 units, down 5.22% year-on-year; Although the cumulative sales volume of SAIC-GM-Wuling reached 1,051,400 vehicles, up 6.74% year-on-year, the profit margin of its products is limited, which is a drop in the bucket for SAIC.

Not only SAIC, but also GAC’s net profit even dropped by 64.71% due to the decline of joint venture brand sales.

Due to the shortage of chips, the production and sales of Guangqi Honda and Guangqi Toyota under Guangzhou Automobile Group suffered a lot in the third quarter. In September this year, Guangqi Honda sold 72,100 vehicles, down 17.92% year-on-year. GAC Toyota sold 48,300 vehicles in September, down 40.37% year-on-year.

China automobile dealers association made some statistics and early warning. On November 1st, the association released the "Market Insight and Price Monthly Report in October 2021", which showed that under the influence of chip shortage, the production capacity of head manufacturers such as Volkswagen, Honda and Toyota were greatly affected, and the sales volume continued to decline. The year-on-year decline in September expanded to 31.0%, and the lack of core remained the biggest obstacle to the rise of the joint venture market in the short term. "If the pressure on chip supply is not effectively alleviated, it is expected that the joint venture market will continue to experience a significant decline in the fourth quarter." The monthly report pointed out.

For Guangzhou Automobile Group, its new energy is worth showing off. From January to September, Guangzhou Automobile Aian, a new energy subsidiary of Guangzhou Automobile Group, produced and sold nearly 80,000 vehicles, with an increase of 95.91% in output and 104.01% in sales.

Thanks to the improvement of the operation of independent brands, the gross profit margin of Guangzhou Automobile Group has been improved. The financial report shows that its gross profit margin in the third quarter reached 6.33%, up 0.78 percentage points from the previous quarter and 3.25 percentage points from the same period last year.

It can be seen that for car companies that have long relied on joint ventures, there is a situation in which strong joint ventures have strong performance and weak joint ventures have weak performance. If there is a big decline in the joint venture brand, it will directly affect the group’s profit. Therefore, how to improve the profitability of independent brands is one of the important problems faced by car companies.

However, in China’s automobile brand sector, its third-quarter financial report also shows that manufacturers are under pressure, such as Great Wall Motor, BYD, Xiaokang and Beiqi Blue Valley, all of which increase their income without increasing their profits.

The data shows that Great Wall Motor’s revenue increased by over 10% in the third quarter, but its net profit was 1.416 billion yuan, slightly lower than 1.44 billion yuan in the same period last year. In this regard, soochow securities said that the decline in profits of Great Wall Motor in the third quarter was affected by factors such as lack of core in the industry and the provision of equity incentive fees.

Great Wall Motor’s financial report data shows that the operating costs in the first three quarters rose sharply, rising by 46% from 51.88 billion yuan in the same period last year to 75.74 billion yuan, among which the sales expenses and management expenses all increased significantly.

BYD is also deeply troubled by rising costs. The car company achieved operating income of 54.307 billion yuan in the third quarter, a year-on-year increase of 21.98%; The net profit of returning to the mother was 1.27 billion yuan, down 27.50% year-on-year. In this regard, CITIC Securities Research Report pointed out that the price increase of upstream raw materials and the decrease in income of medical protection products after the normalization of the epidemic are the two main reasons that affect BYD’s performance.

Surprisingly, although the continuous increase in income does not increase profits, it does not prevent BYD’s share price from rising all the way. Since the low point in May, the company’s share price has doubled in less than half a year. On November 2nd, BYD closed at 313.88 yuan per share, an increase of 3.93%.

According to the analysis of Shanghai Securities, the next few years will be a period of rapid release of BYD’s profits, and the company’s profits will show a nonlinear rapid growth. Blade lithium iron battery and DM-i have changed from initial doubt to trend, indicating that the company’s innovation is gaining market recognition.

Only Changan Automobile, a car company, has a red net profit.

During the reporting period, Changan Automobile achieved an operating income of 22.4 billion yuan, a slight decrease of 2.8% year-on-year; The net profit attributable to shareholders of listed companies was 884 million yuan (adjusted), up 42.9% year-on-year; The net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 519 million yuan (after adjustment), a year-on-year increase of 92.67%.

The operating income and profitability of this car company have steadily increased, which is closely related to market sales.

Since the beginning of this year, with the sales growth and product structure optimization of Changan Automobile, the profitability of independent business has been greatly improved, and the company’s performance is continuing to improve. The data shows that in the first three quarters of this year, the sales volume of Changan Automobile increased by 26.4% year-on-year, and the cumulative sales volume reached 1.732 million units.

However, the financial report shows that due to repeated overseas epidemics and chip shortage, Changan Automobile production failed to meet the market demand in the third quarter, and the ratio of warehouse to sales was at a historical low. Among them, Changan Automobile’s sales in September decreased by 8.41% year-on-year to 188,200 units. However, the company said that with the recovery of overseas chip production capacity, it is expected that supply and demand will tend to improve.

The shortage of automobile chips has ushered in an inflection point. On November 1st, china automobile dealers association released the latest issue of "Automobile Consumption Index", showing that the automobile consumption index in October was 66.1. The association pointed out that the current chip shortage problem has eased slightly, but the automobile market is basically in a state where supply determines demand, and the overall market demand continues to delay accumulation. With the easing of market capacity supply, market demand has been partially released. In the fourth quarter, dealers began to impulse and increase sales promotion. With the improvement of supply satisfaction, car sales in the fourth quarter are expected to increase compared with the third quarter.

▍ Continuous investment

Innovation-driven, investing heavily in research and development, and introducing first-class talents … This is the commonality of world-class manufacturing enterprises, and it is also a topic that independent automobile brands need to face together-only innovation-driven and technology is king can we achieve "overtaking in corners" in key core technologies.

Although the profits of most car companies declined in the third quarter, it did not prevent mainstream car companies from increasing R&D investment. Some insiders said that with the wave of globalization, R&D innovation has become a necessary means for car companies to maintain their competitive advantage and obtain rich profits.

In terms of financial report data, SAIC led by 4.836 billion yuan, followed by BYD, Changan Automobile and Great Wall Motor. The R&D expenses of the three car companies in the third quarter reached 2.238 billion yuan, 2.085 billion yuan and 1 billion yuan respectively. Although Beiqi Blue Valley and Jianghuai Automobile were still losing money in the third quarter, their R&D expenses both exceeded 200 million yuan, increasing by 40% and 28% respectively.

Judging from the R&D expenses in the first three quarters of this year, many enterprises have invested more than 1 billion yuan in R&D.. Among them, the accumulated R&D expenses of SAIC have exceeded 10 billion yuan, reaching 12.6 billion yuan, up 41.55% year-on-year. SAIC explained in the financial report that the reason for the increase in R&D expenses is to further increase R&D investment in new energy, intelligent networking, digitalization and other technologies.

In the era of digital intelligent Internet of Things, with the large-scale popularization of 5G and AI technologies, the automobile manufacturing industry is welcoming a subversive change. The mainstream car companies represented by SAIC, BYD, Changan Automobile and Great Wall Motor are realizing the transformation from "following" to "leading".

On October 29th, the news that SAIC set up Feifan Automobile and planned to set up Zero Beam Technology Company was announced at the same time as the third quarterly report.

Feifan Automobile has a registered capital of 7 billion yuan. Among them, SAIC subscribed 6.65 billion yuan, accounting for 95% of the registered capital. Shanghai Ruyuan Automotive Technology Partnership (Limited Partnership) (employee stock ownership platform) subscribed for 350 million yuan, accounting for 5%.

SAIC said that the company will market the R brand as an independent brand and company through Feifan Automobile, explore a new model of data-driven and industrial co-creation, and accelerate the development of the mid-to-high-end smart electric vehicle market.

In addition to the continuous transformation of the R brand, SAIC also plans to set up a company called Zero Beam Technology on the same day, which is positioned as a platform-based software technology enterprise.

The registered capital of Zero Beam Technology is 3.7 billion yuan, of which 3.45 billion yuan is subscribed by SAIC, accounting for 93.24% of the shares. Shanghai Zero-Rise Technology Partnership (Limited Partnership) (employee stock ownership platform) subscribed for 250 million yuan, accounting for 6.76%.

In addition, SAIC’s capital operation continues. Today, SAIC Hongyan has been injected as a wholly-owned subsidiary of the listed company SAIC. Next, SAIC’s RV lifestyle and Youdao Zhitu will also strive for IPO. SAIC also launched Jiehydrogen Technology to introduce strategic investors, enjoy a new round of external financing, and Zhonghaiting A round of financing.

Changan Automobile is also accelerating its investment. On August 24th, at the Changan Automobile Technology Ecology Conference, Changan Automobile released its high-end new energy automobile brand Aouita, and also announced the partial shape of the first high-end intelligent electric medium-sized SUV E11 jointly built by Changan (C), Huawei (H) and Contemporary Amperex Technology Co., Limited (N) of Aouita Technology.

According to the plan, in the next five years, Changan Automobile expects to invest a total of 150 billion yuan in the whole industry chain to build the technology ecology of technology companies and accelerate the construction of software and intelligent capabilities.

In order to deepen the layout of the new track and accelerate the landing of new technologies, Great Wall Motor continued to increase R&D investment in the first three quarters of this year, and the cumulative R&D investment scale has exceeded that of last year.

For example, Great Wall Motor has already set up Salon Zhixing. It is reported that the "Z brand" affiliated to Salon Zhixing may be released at this year’s Guangzhou Auto Show. In addition, the Great Wall and BMW’s beam car will also be completed and put into production in 2022.

Guangzhou Automobile Group also issued a number of announcements, involving the implementation of the construction project plan of Guangzhou Automobile Ai ‘an self-developed battery trial production line, the implementation of its joint venture brand Guangqi Honda HQ model project, and the participation of Guangzhou Automobile Industry Group, the controlling shareholder of Guangzhou Automobile, in the financing of 1 billion yuan. Guangzhou Automobile Group is accelerating the development of electrification, intelligence and sharing.

▍ Breaking overseas

As a technology-intensive industry, the automobile manufacturing industry is in a critical period of transformation and upgrading and technological innovation. In the future, how should China automobile enterprises find high-quality resources and become the most competitive global enterprises? This is an important issue that most independent brands face in the new round of global competition.

At present, Chinese automobile brands are increasing their export and overseas expansion. China’s advantages in the field of new energy vehicles have opened the second growth curve for the export of China brand cars. At the same time, relying on the development experience and technical ability accumulated in the field of new energy for many years, China brand cars have achieved the "going out" of technical standards.

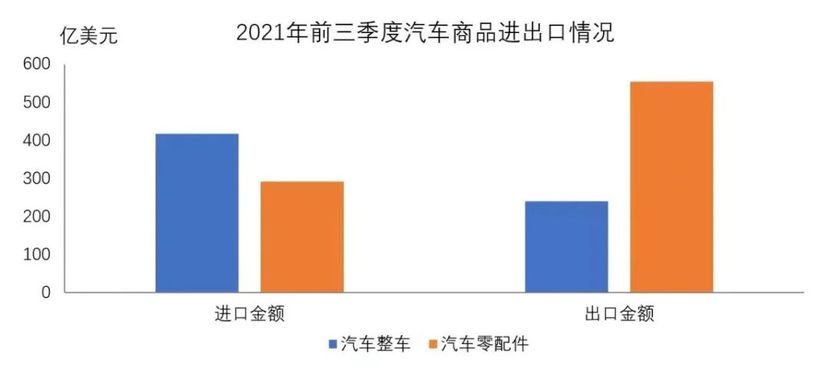

▲ Image source: China Automobile Association

According to the data analysis released by the General Administration of Customs compiled by China Automobile Industry Association, in the first three quarters of 2021, the total import and export volume of automobile goods exceeded 150 billion US dollars, which continued to maintain rapid growth year-on-year. In the first three quarters, a total of 1.492 million vehicles were exported, a year-on-year increase of 1.1 times; The export value was US$ 24.04 billion, a year-on-year increase of 1.2 times.

Cui Dongshu, secretary-general of the Association, analyzed that the supply advantage brought by the complete industrial chain of China automobile was further amplified under the influence of overseas epidemic, especially the shortage of chips was beneficial to China automobile export. The strong rise of China’s automobile export shows that the world competitiveness of China’s automobile industry has been greatly improved.

As the overseas sales champion of single brand in China, the export sales volume of SAIC passenger cars reached 28,000 in September. Among them, pure electric MG EZS has won the third place in Swedish pure electricity market and the fourth place in French pure electricity market.

"China’s automobile exports have continued to grow substantially, which is not unrelated to the gradual recovery of the global automobile market. The overall export scale is obviously driven by the export of new energy vehicles." According to relevant sources of Great Wall Motor, in the third quarter of this year, Great Wall Motor continued to promote global development on a large scale, entering the markets of Egypt, Brunei and Europe, and further expanding the global sales territory of Great Wall Motor.

In terms of overseas sales, with the help of the third-generation Haval H6, Haval First Love, Haval Big Dog and Great Wall Gun, the cumulative overseas sales of Great Wall Motor in the first three quarters reached 98,000, up 136.3% year-on-year, and the overall sales accounted for 11.1%.

▲ Great Wall Motor landed at Munich Auto Show

Like Great Wall Motor, China car companies such as Chang ‘an, Jianghuai, Geely and Chery are also accelerating the pace of global distribution, focusing on expanding the national and regional markets along the Belt and Road through mergers and acquisitions, setting up factories and introducing new products.

On November 1, Changan Automobile announced that from January to October this year, under the guidance of the national "Belt and Road" strategy, the cumulative export of Changan Automobile’s own brands exceeded 100,000 vehicles for the first time, reaching 102,029 vehicles, a year-on-year increase of 135%, a record high for Changan’s overseas exports, and the annual sales target was reached two months ahead of schedule. Among them, more than 90% of the sales come from the "Belt and Road" countries.

Shi Jianhua, Deputy Secretary-General of China Automobile Industry Association, believes that China’s automobile market has entered a stage of low-speed steady growth and intensified competition. As the world’s largest producer and marketer for 12 consecutive years, China’s automobile industry is in a critical development period of transformation and upgrading, from big to strong. China automobile enterprises should establish brand awareness, actively expand the international market, actively participate in the formulation of international standards and regulations, and constantly expand themselves in the global market competition.

关于作者