Text/Lu Shiming

Editing/Gale

In the past week or two, Wahaha and Nongfu Spring, two industry giants, have been caught in an unprecedented storm.

Since Zong Qinghou’s death, there have been many articles and videos on the Internet "praising Wahaha and stepping on Nongfu Spring", resulting in completely different market performances between the two.

Among them, Wahaha’s official flagship store sales rose by 500% and are continuing to climb; Nongfu Spring’s official flagship store sales plummeted by 90% and are continuing to deteriorate.

Broadly speaking, these contents can be roughly divided into three categories.

The first type of rhetoric is that Zhong Xuanyuan was a former employee of Wahaha, and then "betrayed" Zong Qinghou to set up his own business and stage a real-life version of "The Farmer and the Snake".

The second category believes that Zhong Shanshan’s son, Zhong Shuzi, is an American citizen, and Nongfu Spring may become an American enterprise in the future.

The third category says that Wahaha is a local state-owned holding company, while Zhong Xuanyuan personally holds 84.41% of Nongfu Spring’s shares directly and indirectly, and is a pure "capitalist".

Regarding these three types of statements, some of them are completely fabricated stories, some of which are indeed true, but they are only one-sided facts.

In fact, for the two companies, there is no need to continue to be caught in this whirlpool. Especially for Wahaha, at this critical stage of Zong Fuli’s full takeover, it should return to daily operations, so that Wahaha can achieve more stable development.

Different entrepreneurial eras, different business concepts

Zhong and Zong Qinghou are undoubtedly the most famous entrepreneurs in China’s mineral water market. They founded two giant enterprises, Nongfu Spring and Wahaha, respectively, but their development paths are very different.

The reason is that the business philosophy of the founders of the two companies has undergone tremendous changes due to the changing times.

In 1987, Hangzhou City, Shangcheng District Bureau of Culture and Education to the subordinate school-run enterprise distribution department using the way of contracted management, and open selection of the head of the distribution department, although demanding conditions, but 42-year-old Zong Qinghou initiative to "try", and borrow 140,000, contracted the loss of the school-run enterprises, which is the prototype of Wahaha.

In 1996, Wahaha launched its own eye-catching product, Wahaha Red Drink, which soon enjoyed a good reputation in the market. After that, it continuously launched new products and gradually formed its own brand, which achieved success.

As a "competitor" for half his life, Zhong Xuanyi was born in 1954, 9 years younger than Zong Qinghou. At the age of 29, he became a reporter of the rural department of Zhejiang Daily. At the age of 34, he quit his job and went south to Hainan to start a business. He grew mushrooms, sold curtains, and raised shrimp, but he failed.

Zhong Shansui and Zong Qinghou first crossed paths in 1991, when Zhong Shansui became the distributor of Wahaha Oral Liquid in Hainan and Guangxi.

Five years later, in 1996, Mr. Zhong left Wahaha to found Xin’anjiang Yangshengtang Drinking Water, the predecessor of Nongfu Spring. At the end of 1997, Nongfu Spring’s 550ml sportswear for drinking natural water was officially launched. Over the next few years, Mr. Zong and Mr. Zhong competed on the drinking water circuit.

Zong Qinghou founded Wahaha and Zhong Shansui founded Nongfu Spring, which was nearly a decade apart. The changes of the times in the past ten years have also made a huge difference in the business philosophy of the two people.

After 1992, the spring breeze of reform and opening up blew, and the business philosophy of enterprises also changed from the closed type of product economy to the open type of commodity economy. The market-oriented management consciousness was greatly strengthened, and the user concept, market concept, competition concept, benefit concept, and information concept constituted the main body of enterprise management ideology.

Zong Qinghou, as an old-school entrepreneur who started a business before the reform and opening up, is more patriotic and pays more attention to the product itself. Many entrepreneurs who started a business after 1992 have more modern company thinking and are better at market-oriented management.

Therefore, the competition between the two companies over the years can also be seen as a contest of entrepreneurial thinking in different eras. Among them, the most intense confrontation between the two companies was the "Daffodil" incident.

In April 2000, through the "daffodil" experiment, the growth rate of daffodil watering with purified water and Nongfu Spring natural water was slower than that of natural water. Zhong Shanyuan held a press conference to announce that due to scientific experiments proving that purified water is not beneficial to human health, Nongfu Spring no longer produces purified water, only natural water.

Subsequent to this, 69 companies, including Wahaha, Robust, and Jingtian, jointly issued a statement saying that the daffodil experiment was fooling and misleading consumers, that pure water that met the standards was safe and hygienic healthy drinking water, and that Yangshengtang used false and pseudoscientific means to deny and devalue pure water as a whole, which is unfair competition.

The final result of this matter was terminated by Nongfu Spring being fined 200,000 for improper competition.

But the business war is a contest between perceptions. Although Nongfu Spring seems to have lost, Nongfu Spring’s concept of "natural water is healthier" has won the approval of consumers virtually.

Later, under marketing campaigns such as "Nongfu Spring is a little sweet" and "We don’t produce water, we are just nature’s porters", the sales of pure water in Wahaha declined year by year, and the sales of Nongfu Spring increased year by year.

In 2023, Nongfu Spring will account for 26.5% of the overall drinking water market share, while Wahaha will account for 9.9%.

Different capital structures, different public opinion directions

So far, the "capital structure" of the two companies has also been a focus of attention among netizens.

According to Tianyancha, Wahaha Group’s largest shareholder is Hangzhou Shangcheng District Cultural Business Travel Investment Holding Group Co., Ltd., which holds a 46% stake. Behind it is the State-owned Assets Supervision and Administration Commission of Hangzhou Shangcheng District. Zong Qinghou holds a 29.4% stake alone, and the Wahaha Group’s labor union holds a 24.6% stake.

Source: Tianyancha

As for Nongfu Spring, Zhong Xuanyuan controlled 84% of Nongfu Spring’s shares through direct and indirect shareholding, with a shareholding ratio of 0.63% for Pioneer Navigation Group; 0.63% for BlackRock Group; 0.25% for State Street Global Advisors; and 0.14% for Hang Seng Investment Management Company.

Because of the investment of the State-owned Assets Supervision and Administration Commission, Wahaha was mistakenly called a "state-owned enterprise"; because of the investment of US and Japanese capital, Nongfu Spring was also mistakenly called a "foreign-funded enterprise".

For a long time, many large domestic enterprises have foreign investment, such as Tencent’s largest shareholder is a South African media group, BYD’s largest shareholder is Hong Kong Central Clearing Co., Ltd., and Alibaba’s largest shareholder was SoftBank Group.

It is worth noting that Wahaha also introduced foreign investment in its early years.

After 1992, China was experiencing a new upsurge in economic development, and the practice of opening up to the outside world and utilizing foreign capital went from exploring the way to rapid development. On the one hand, foreign capital needs to borrow the power of Chinese enterprises to open up the Chinese market; on the other hand, introducing foreign capital is the choice for many local enterprises to get rid of the development bottleneck.

For Wahaha in the 1990s, when the country’s preferential foreign investment policies attracted multinational companies to the Chinese market, if they did not expand their scale and improve their market competitiveness, they might be eliminated by the market.

Of course, Wahaha, as a well-known brand in the Chinese market, has long attracted foreign investors.

So, in 1996, Wahaha transferred its 51% stake to Golden Plus (the company set up by France’s Danone and Hong Kong’s Bright Fuller to acquire Wahaha), and the Wahaha brand was adopted to Golden Plus. After more than a decade, the joint venture operation was very successful, and Wahaha quickly stood out in the pure water market.

But by 2006, Danone’s new chairperson, Fan Yimou, found that Zong Qinghou had established a series of non-joint ventures owned by state-owned enterprises and employees outside the joint venture, which also brought huge profits to Wahaha every year.

Fan Yimou believed that the existence of these non-joint venture companies took away the market and profits that should have been enjoyed by the joint venture company, so he demanded to use 4 billion to acquire 51% of the non-joint venture company. Zong Qinghou rejected Danone’s acquisition request. Therefore, Danone launched a full-scale lawsuit against Zong Qinghou and the non-joint venture company.

However, this international commercial war, which has been called the most influential in the past 30 years of reform and opening up, ended in Danone’s defeat.

Source: Baidu Encyclopedia "The Battle of Dawa"

Looking back, in fact, whether it is foreign capital or state-owned assets, both have their positive aspects, which are all for the better and healthier development of enterprises.

Most importantly, whether it is Wahaha or Nongfu Spring, the control of the enterprise has always been in the hands of the Chinese.

A new generation of successors, a new round of competition

In addition to the old story between the two founders and the issue of ownership structure, there are also many articles or videos mentioning the nationality of the "successor" of the two companies.

"If Zhong Shanyuan decides to take a back seat and hand over the business to his son, the future direction of Nongfu Spring and whether it will still be a true national enterprise is uncertain," said one user.

Mr. Zhong’s son, Zhong Shuzi, was born in 1988, according to public records. Mr. Zhong, who received a bachelor’s degree from the University of California in 2011 and began serving as a non-executive director of Nongfu Spring in June 2017, does have American citizenship, according to Nongfu Spring’s previous listing prospectus.

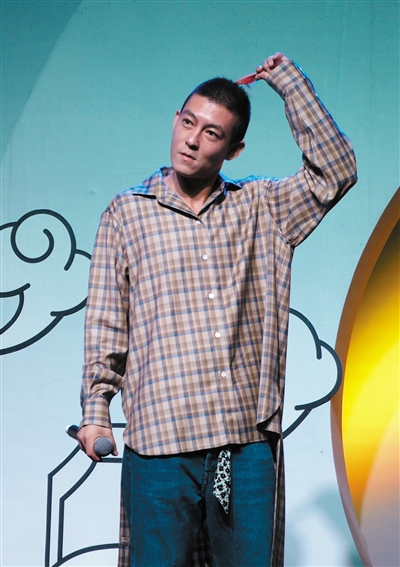

Photo: Zhong Shuzi

With the development of the times, many high net worth individuals have obtained the status of foreign citizens, or their children and spouses have already completed immigration and become foreigners.

According to the Ministry of Commerce’s "Regulations on Foreign Investors’ Mergers and Acquisitions of Domestic Enterprises", if the natural person shareholders of a domestic company change their nationality, the enterprise nature of the company will not be changed. According to the relevant approval of the General Department of the State Administration of Foreign Exchange, enterprises invested and established in China by Chinese citizens before obtaining overseas permanent residency do not enjoy the treatment of foreign-invested enterprises.

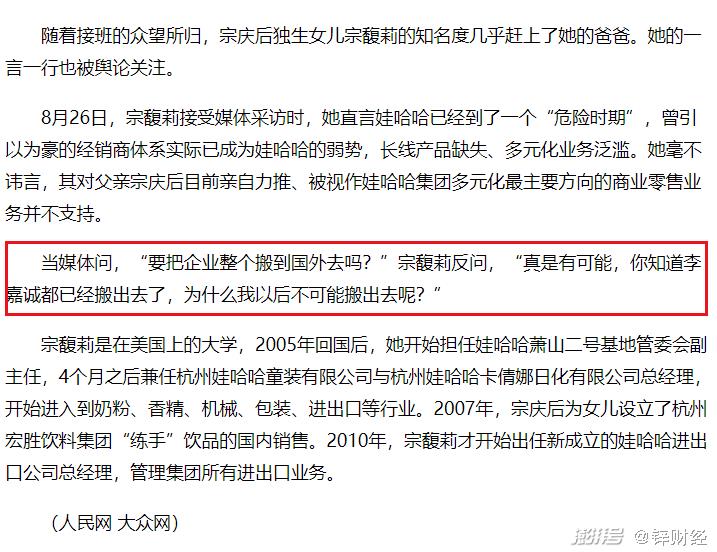

It is worth mentioning that Zong Fuli was also involved in the controversy of American nationality.

Some media have reported that "many members of Zong Qinghou’s family have obtained U.S. green cards or have joined the United States, and he himself obtained a U.S. green card in 1999." Zong Qinghou also admitted that he did have a U.S. green card. At that time, he acquired a U.S. canning factory and opened a trading company to do export business. Later, his daughter went to study in the United States and applied for a U.S. green card for convenience.

In addition, when Zong Fuli was interviewed by the media in the early years, when the media asked, "Do you want to move the entire company abroad?" Zong Fuli asked back, "It’s really possible. You know that Li Ka-shing has already moved out, why can’t I move out in the future?"

Source: Straits Metropolis Daily

Now, with the death of Zong Qinghou, Zong Fuli will fully take over the Wahaha Group.

As the "second generation of enterprises", after 2018, Zong Fuli’s work focus shifted to Wahaha Group, trying to promote brand rejuvenation and diversification. New products such as soda water and sports drinks were launched in large numbers, and IP joint branding and cross-border marketing were also flourishing.

But so far, these efforts have not borne fruit, and many of these projects, such as Wahaha milk tea shop, have ended. Even Zong Qinghou once admitted that the marketing of his daughter has been very lively, but it has not been reflected in sales.

However, it is foreseeable that Zong Fuli’s business philosophy will be more market-oriented.

She has previously said: "The inheritance of a company can actually be more market-oriented, it doesn’t have to rely on blood, it can compete fairly, there are those who are stronger than me and do the company better, I give up."

As a new generation of leaders, Zong Fuli, who has a new generation of business philosophy, can lead Wahaha to compete with the more "mature" Zhong Shanyu and Nongfu Spring to produce new market results, all remains to be seen.